5 Common FSA Terms You Should Know

Flexible spending accounts (FSAs) provide you with a smart way to save money on healthcare and dependent care expenses (depending on the type of FSA you’re enrolled in). When you participate in an FSA, you’re putting money aside before it is taxed so you can save on eligible expenses. However, you may have a number of pre-tax accounts to choose from. Our survey found that half of all Americans have trouble understanding the differences among health spending accounts. Before making your FSA election, here are five FSA definitions you should know.

Claim

To be reimbursed for an FSA-eligible purchase, you must submit a claim. You would then need to provide documentation of the FSA claim to prove that it was an eligible expense. Once you have done that, if your claim is approved, you will then be reimbursed for your purchase.

Documentation

Documentation describes what you provide to prove that an expense is eligible for reimbursement with your FSA funds. For medical FSAs, documentation should include:

- Date service was received or purchase was made

- Description of service or item purchased

- Dollar amount

- Provider or store name

An Explanation of Benefits (EOB) typically contains the information required by the IRS.

Election

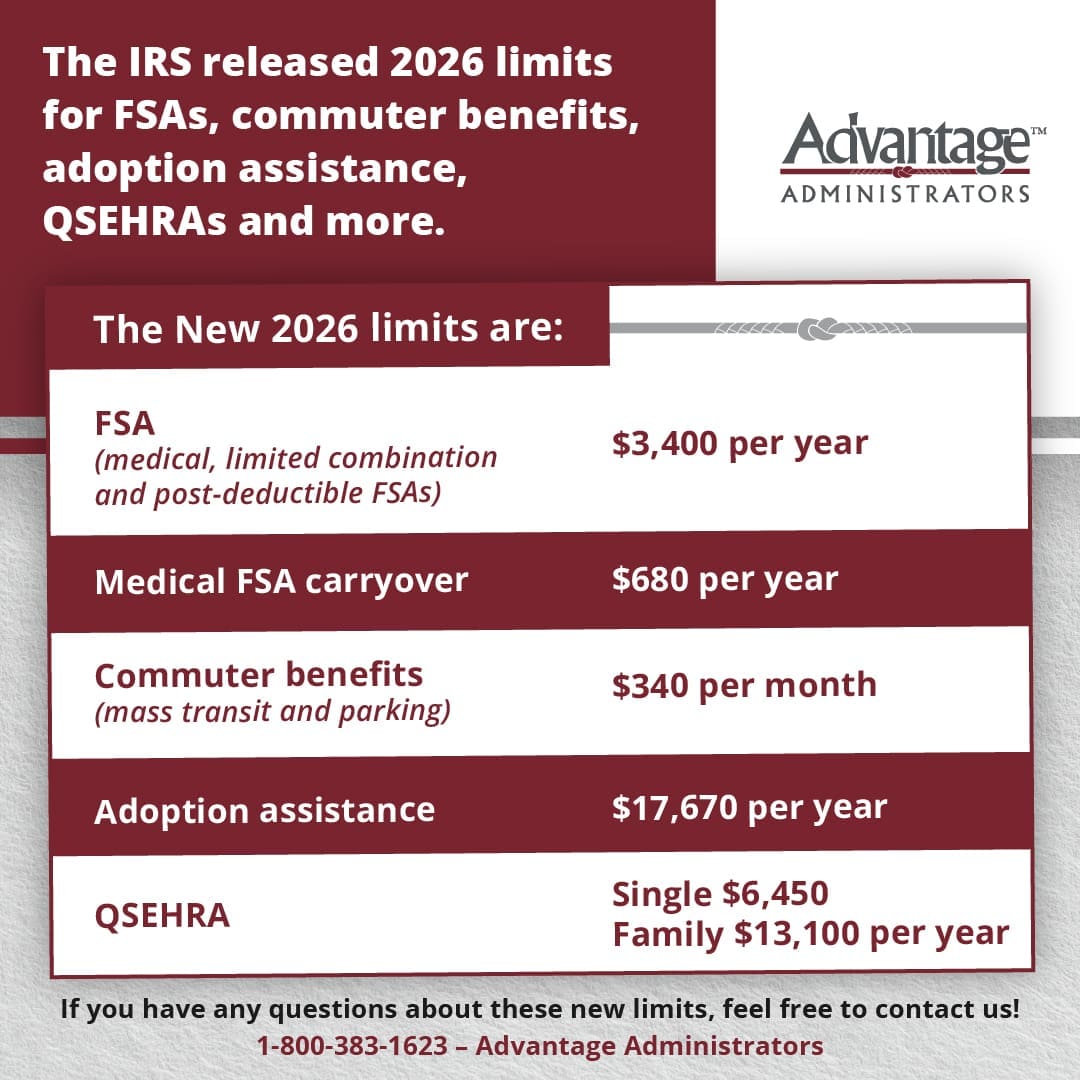

Your election is the amount of funds you choose to have available in your FSA during the plan year. Be aware that the IRS sets contribution limits for medical FSAs and dependent care FSAs (you can find the medical FSA limits for 2026 in this blog post). Your election will then be deducted from your employer’s paycheck on a regular basis throughout the plan year.

Grace period

If your employer’s FSA has a grace period, then you have up to 2 ½ months past the plan year’s end date to incur expenses. For example, if your FSA’s plan year runs from January 1, 2026 through December 31, 2026, that means you would potentially have until March 15, 2027 to incur expenses for your FSA’s 2026 plan year.

Use-or-lose rule

FSAs are governed by the IRS’s use-or-lose rule, which states that any funds in an FSA must be spent by the end of the plan year or else be forfeited to the plan. However, if your employer’s FSA includes a carryover or grace period, then you’ll have additional flexibility to spend down your balance.

The information in this blog post is for educational purposes only. It is not investment, legal or tax advice. For legal or tax advice, you should consult your own counsel. To stay up to date on benefits trends and insights, subscribe to our blog.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store