Partial Self-Funding HRA (Basic and Extreme Bridge)

The employer usually purchases a High Deductible Health Plan (HDHP). The employer then partial self-funds the account to a lower deductible, out-of-pocket maximum or other plan design. The employer receives a savings on their premium versus a regularly priced plan at the same benefit level. A portion of those savings are then used to help cover employee’s medical expenses. Advantage Administrators receives the insurance carrier’s Explanation of Benefits (EOB), and then issues a second EOB that explains the employee’s actual financial responsibility and releases payment when necessary based on the plan design. This type of account MUST be set up in conjunction with group insurance.

A Basic Bridge example would be an employer purchasing an insurance plan with a $5,000 Single/$10,000 Family Deductible. The employer then partial-self funds the plan to a $2,500 Single/$5,000 Family Deductible. The employee pays 100% of the first $2,500 Single/$5,000 Single. Advantage Administrators would then pay on the employer’s behalf 100% of the next $2,500 Single/$5,000 Family until the $5,000 Single/$10,000 Family Deductible was met. The regular insurance conditions would then become effective again. Advantage Administrators issues employees EOB’s explaining their expenses and would also request any funds from the employer that were paid on the employer’s behalf. An Extreme Bridge would be any plan design more complex than this example.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

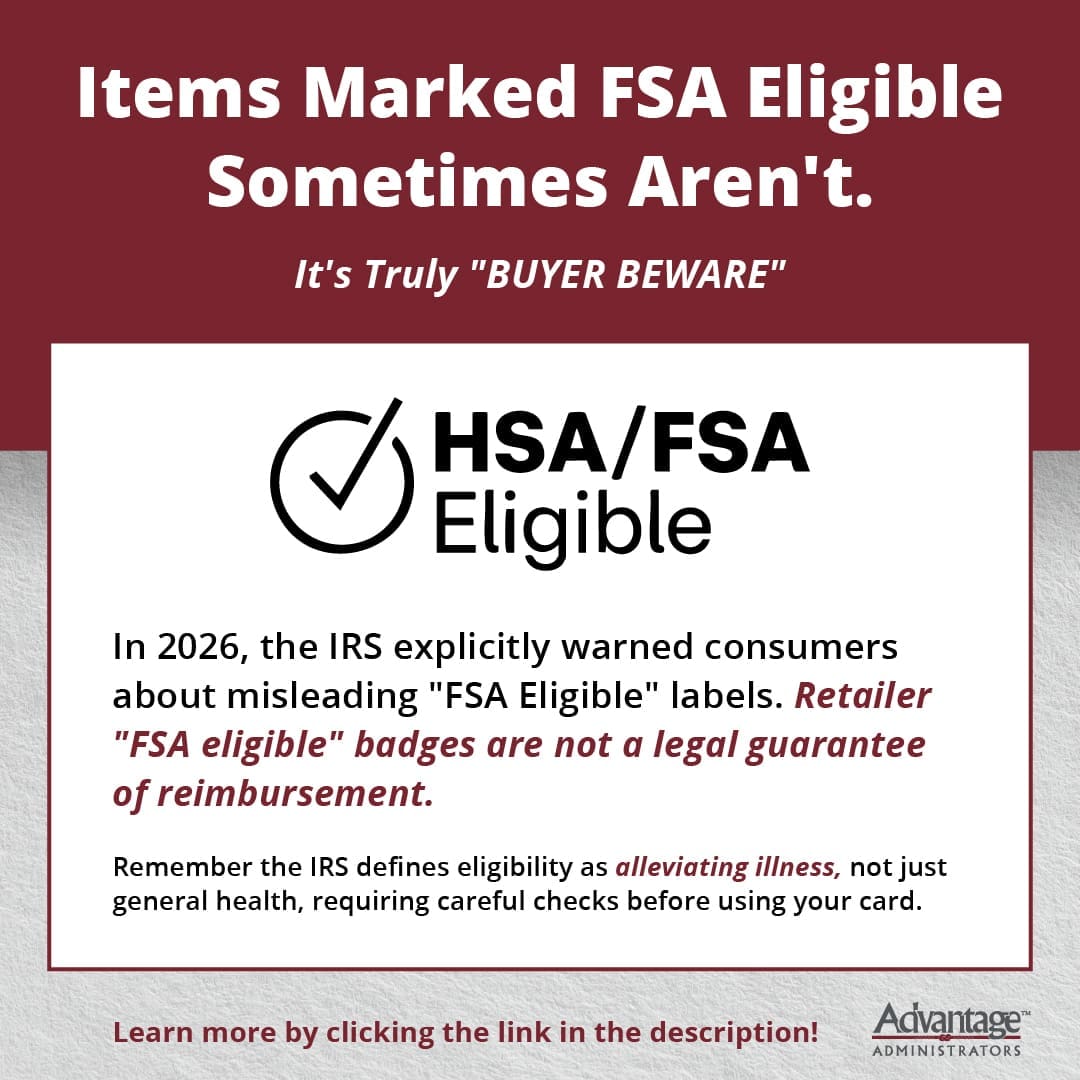

Health Shopper FSA Store

FSA Store