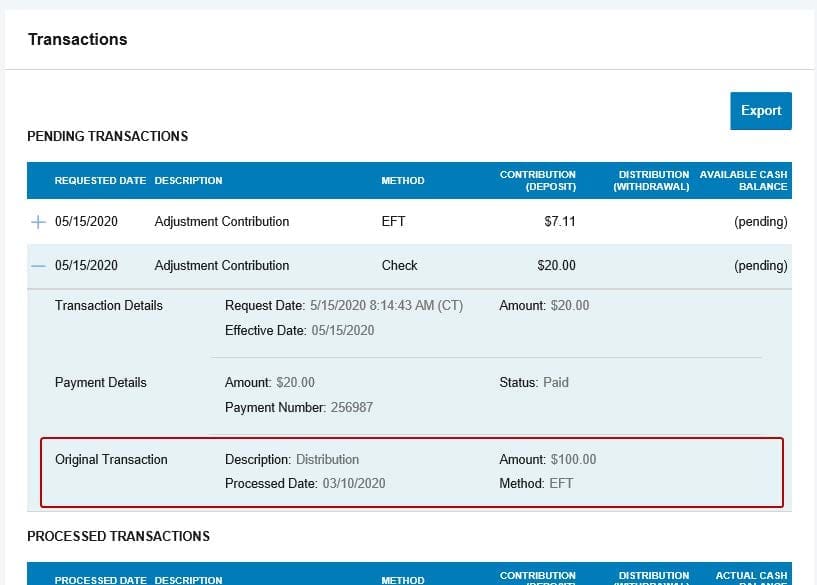

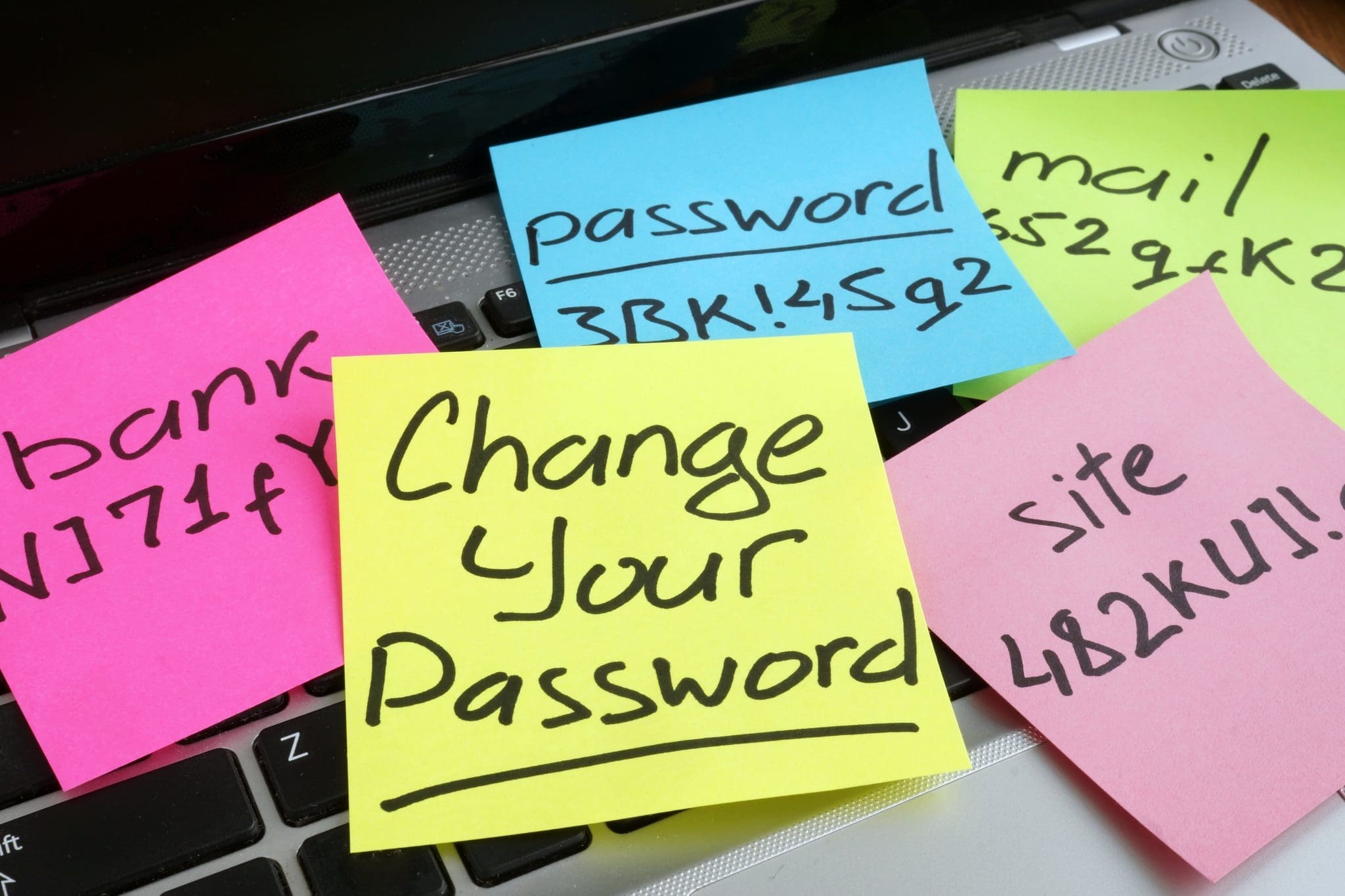

Why FSA Substantiation Matters and What to Look For

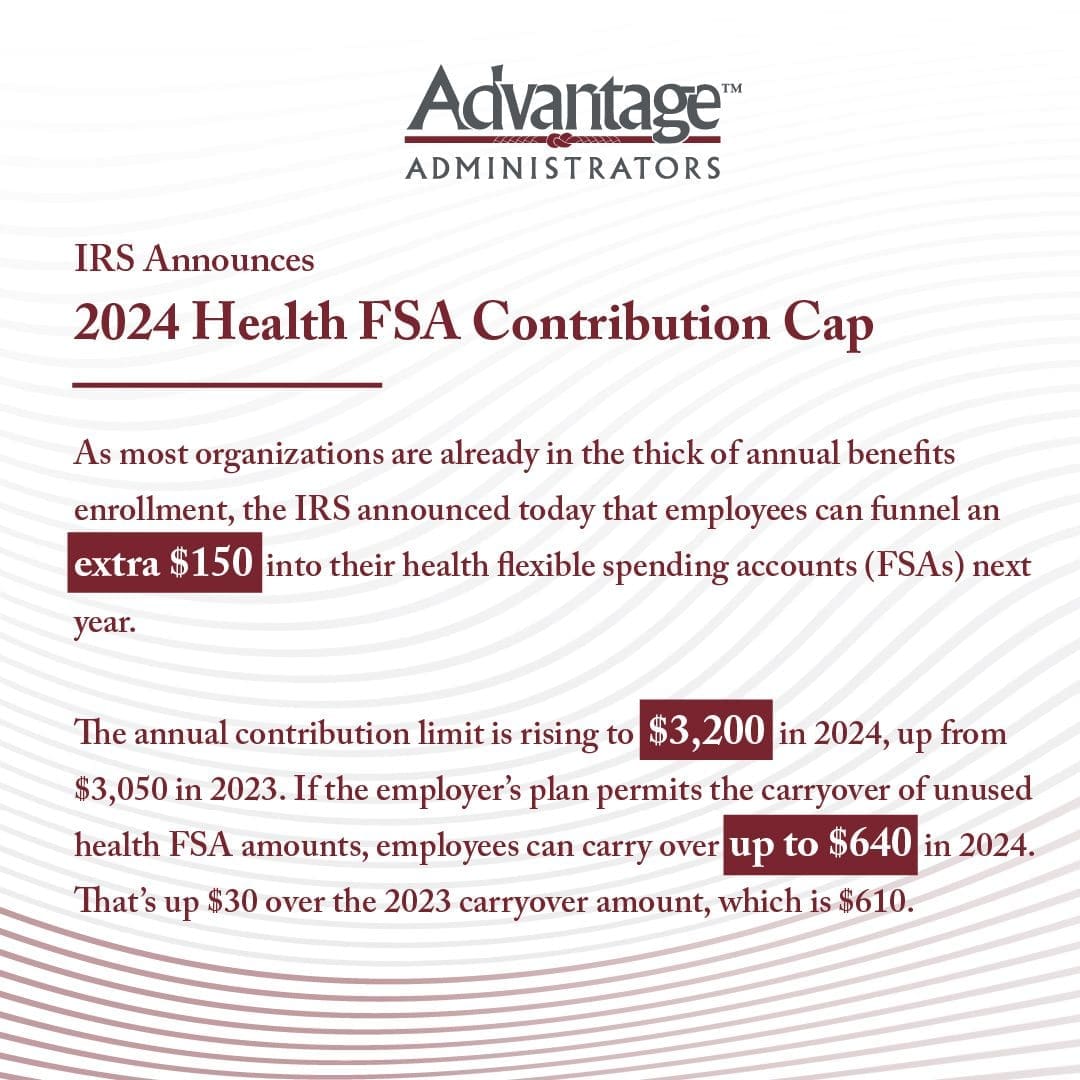

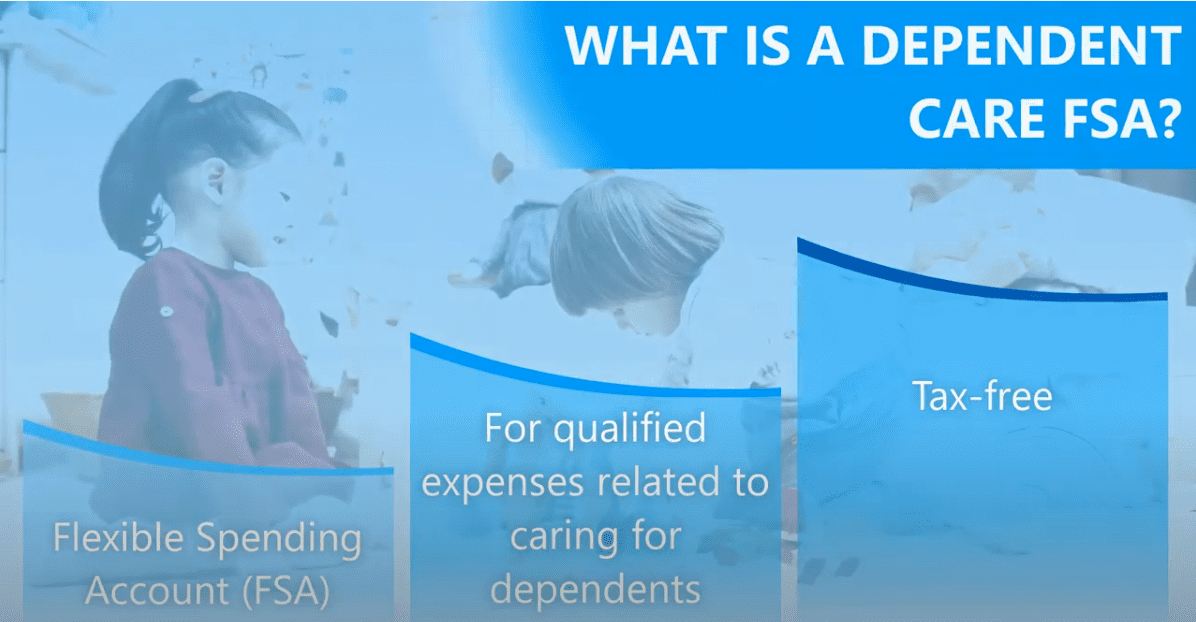

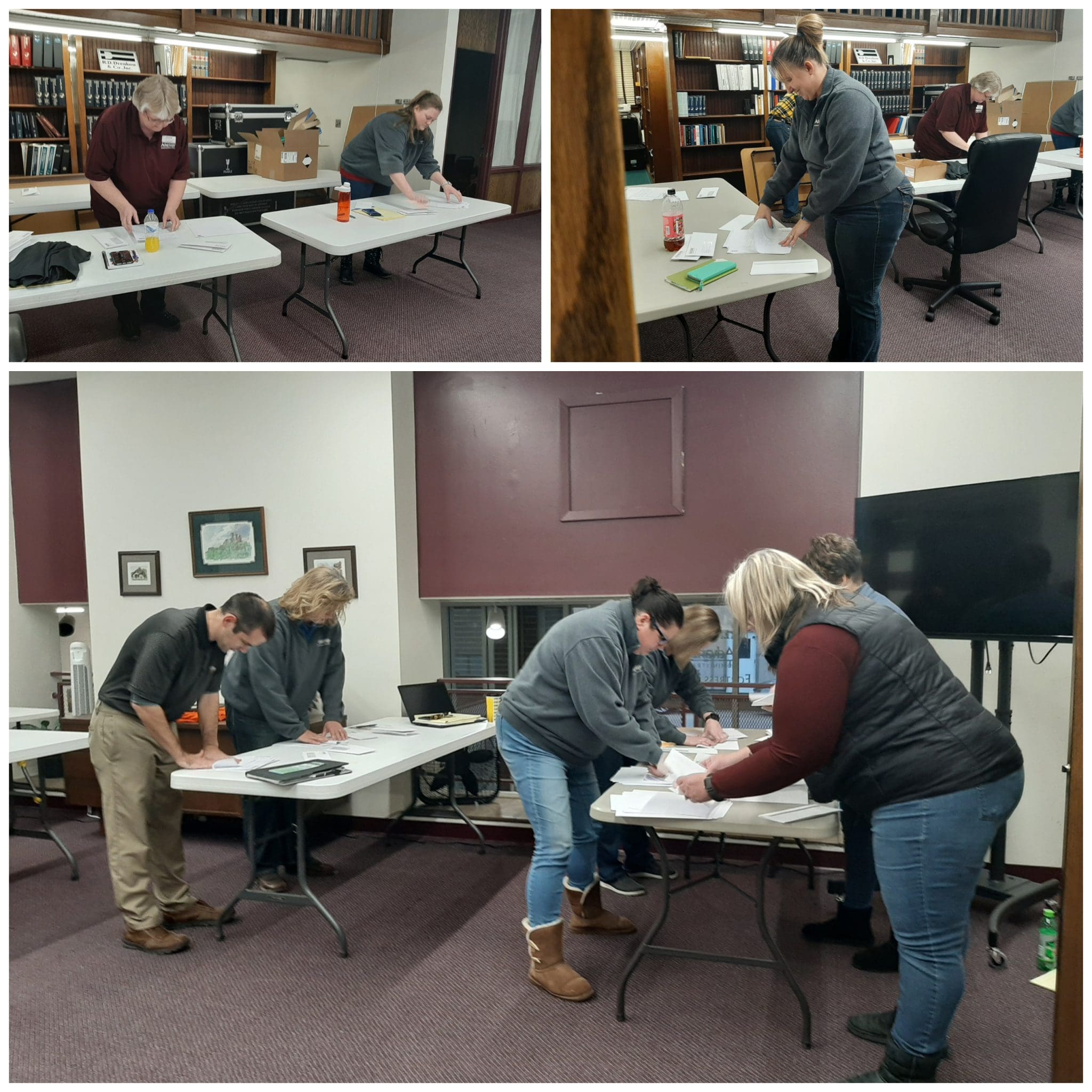

The IRS requires flexible spending account (FSA) participants to submit documentation to prove their purchase was an eligible expense. The IRS emphasized these requirements and potential penalties for employers not meeting the requirements when releasing an Office of the Chief Counsel memorandum detailing medical expense claim substantiation for medical FSAs and dependent care FSAs. That’s...

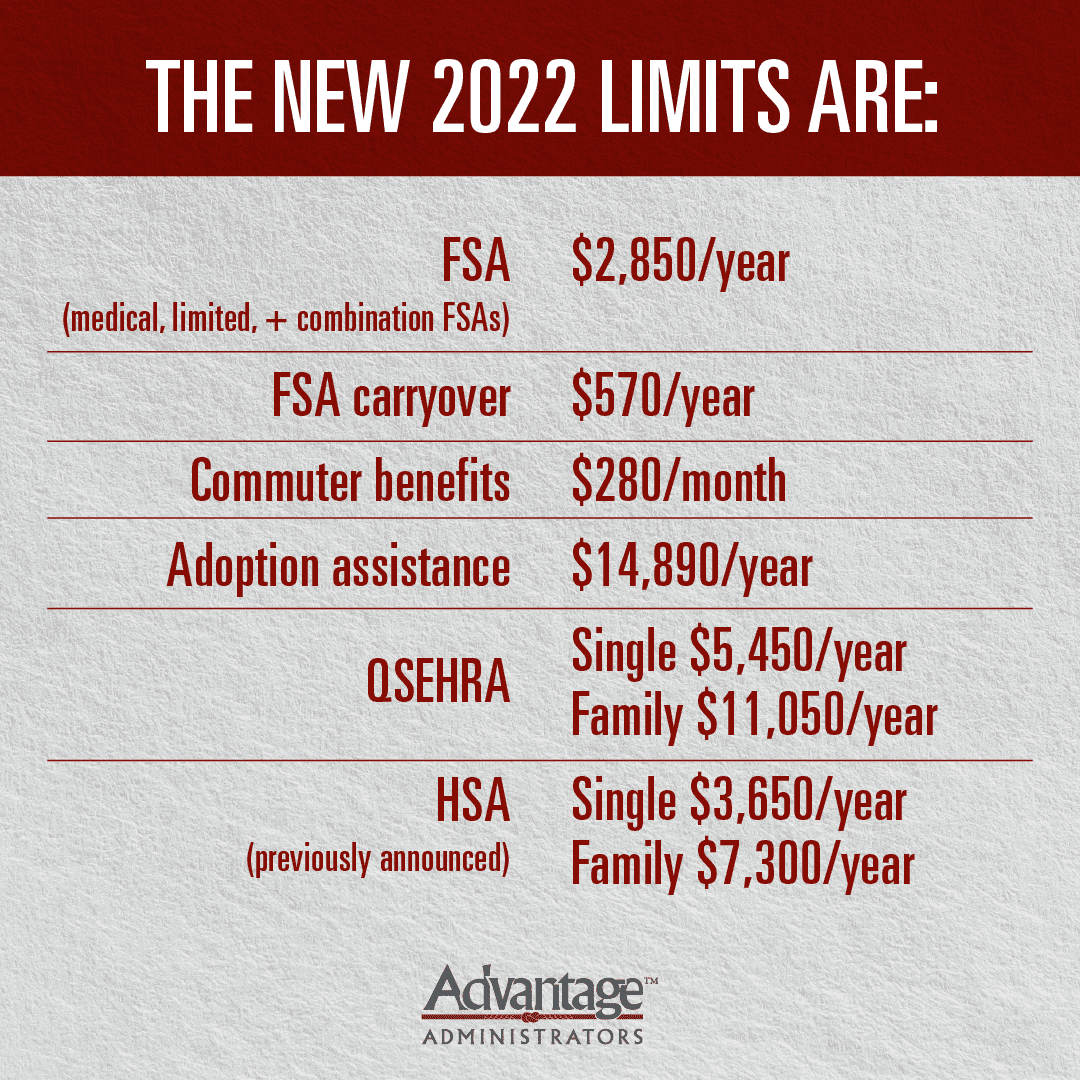

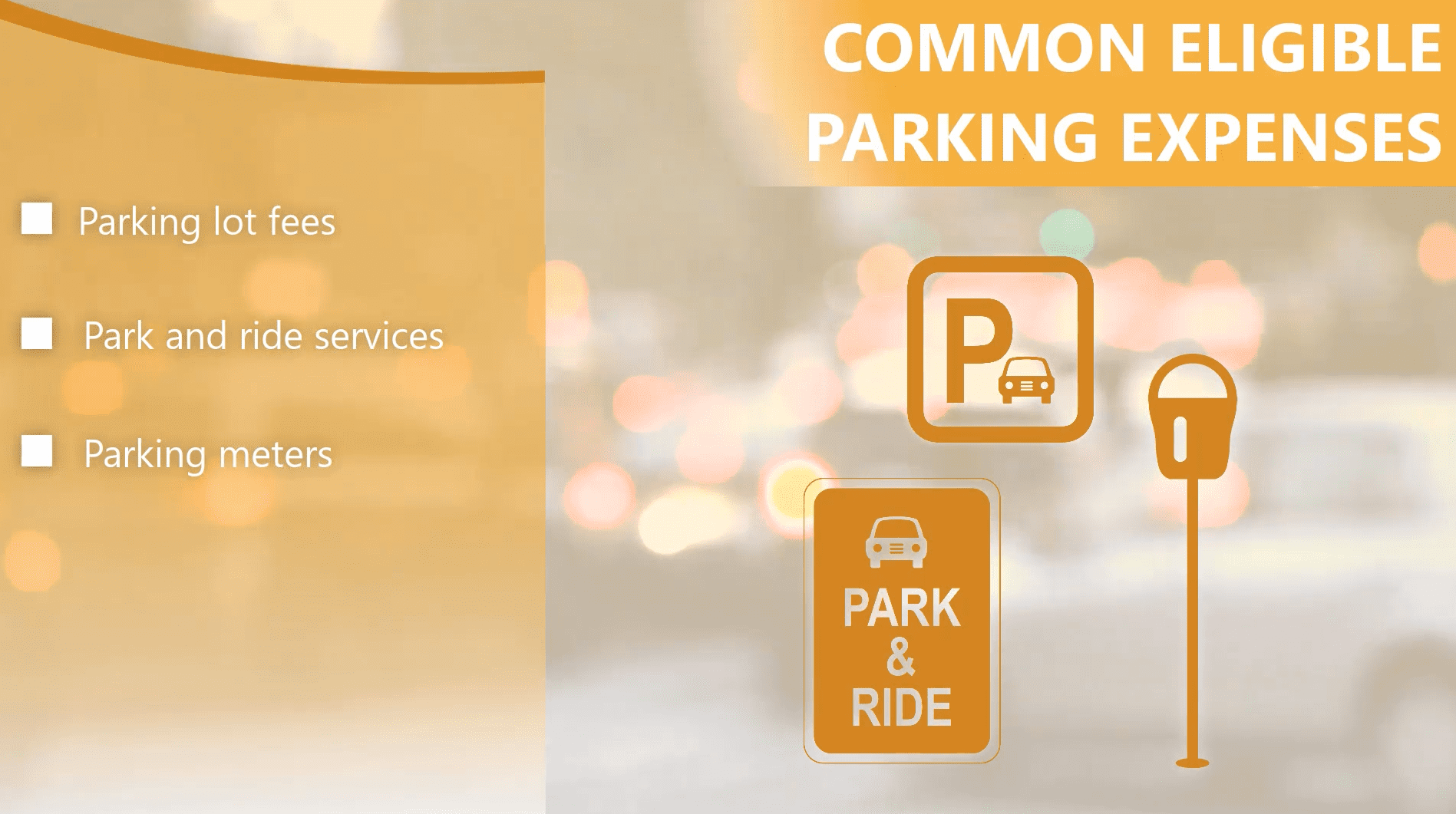

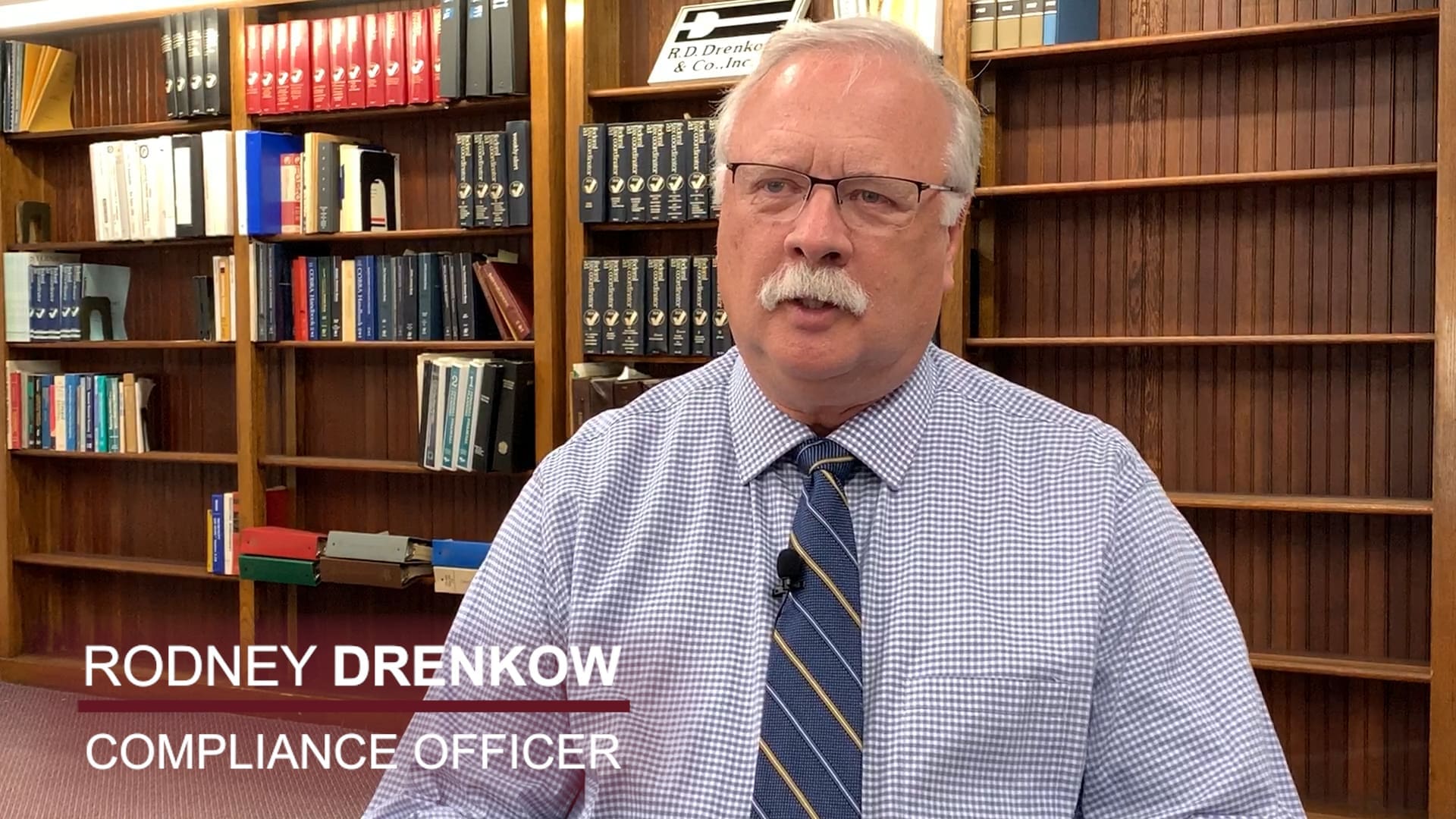

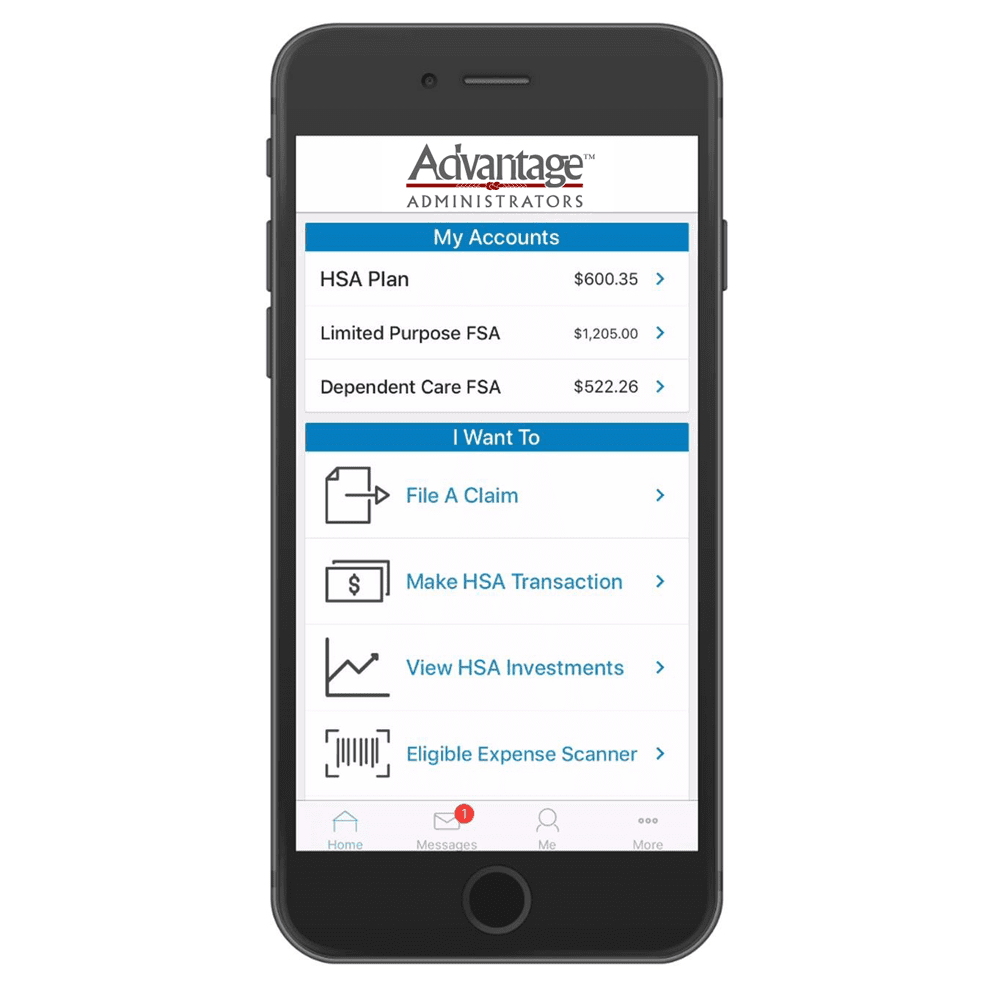

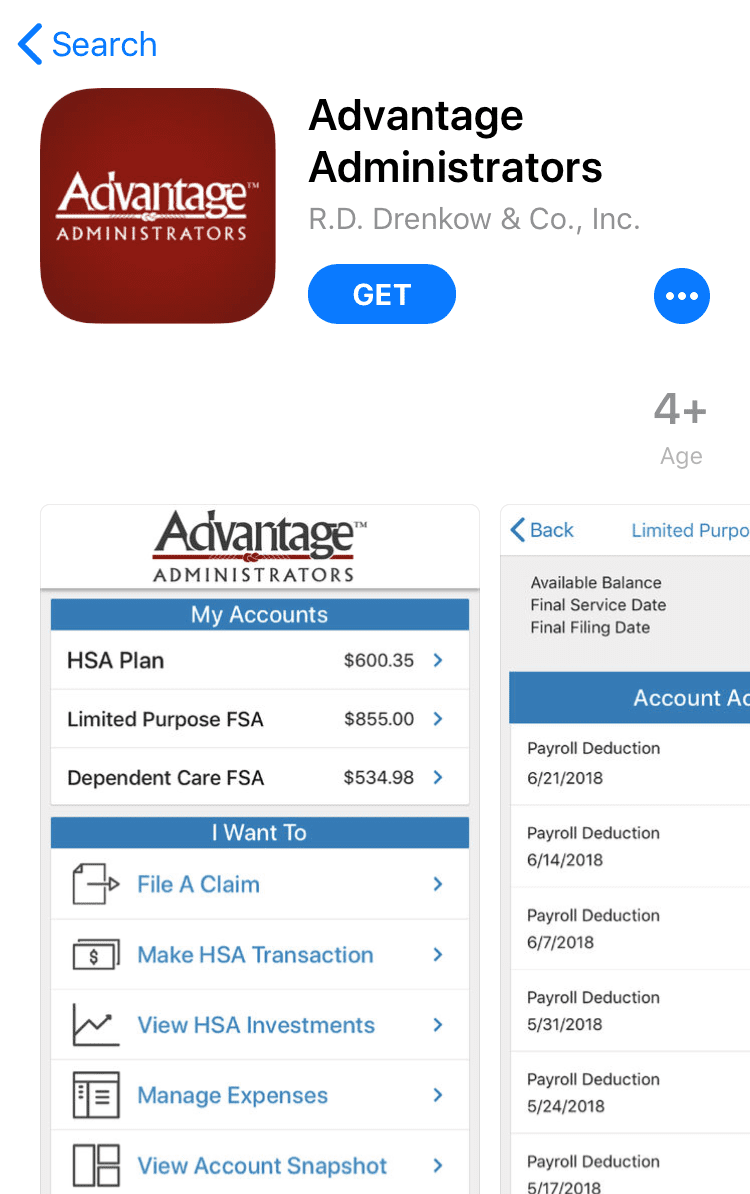

Flex Plans

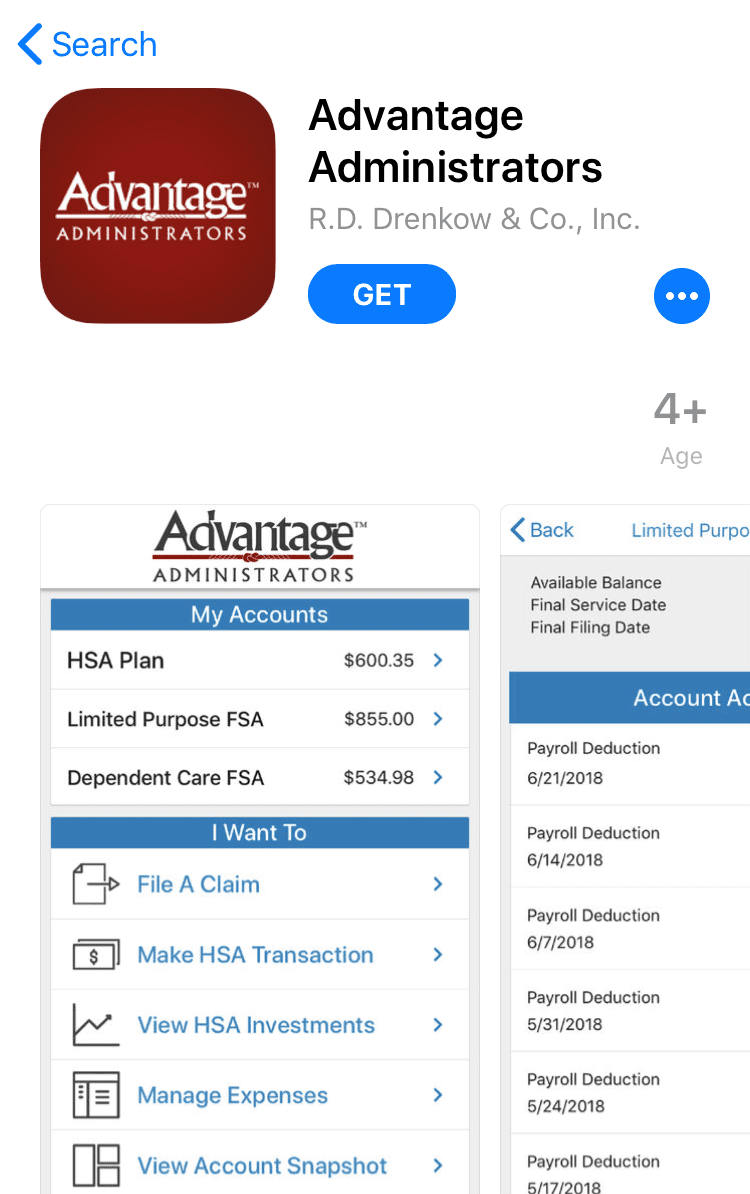

Flex Plans Forms

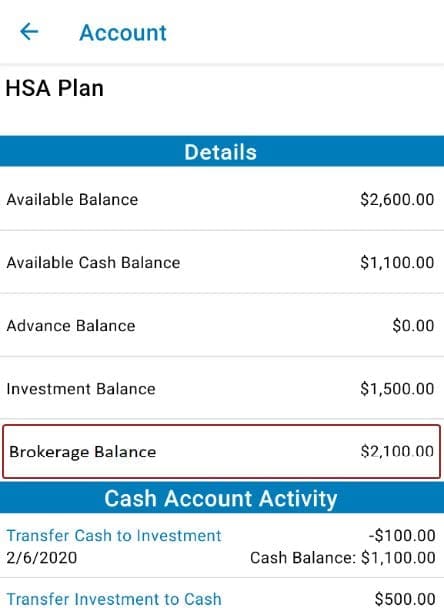

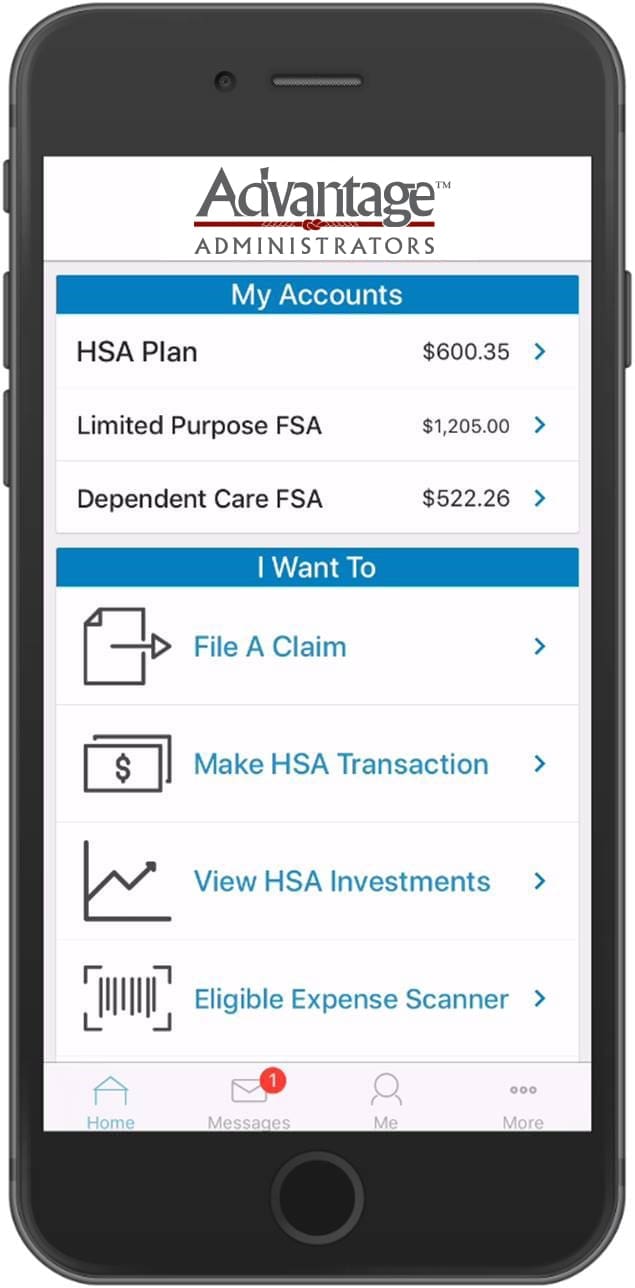

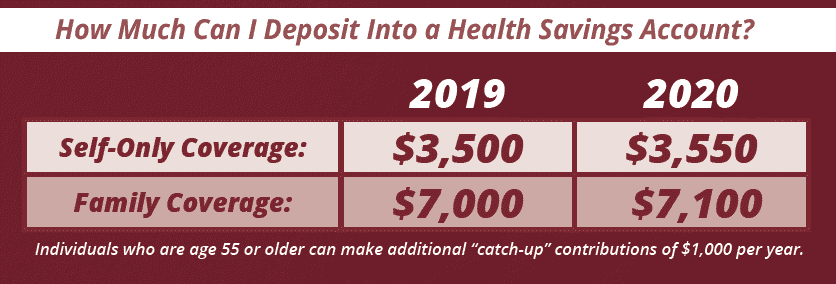

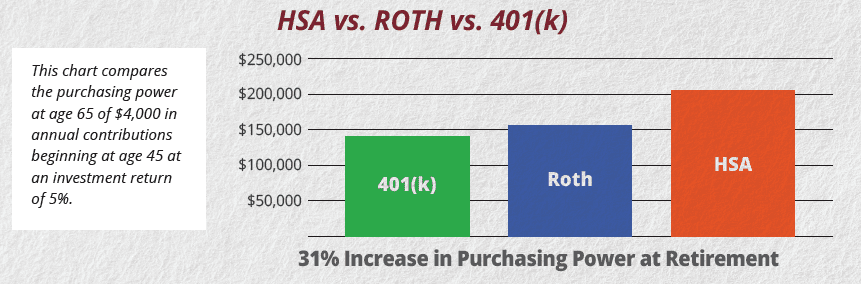

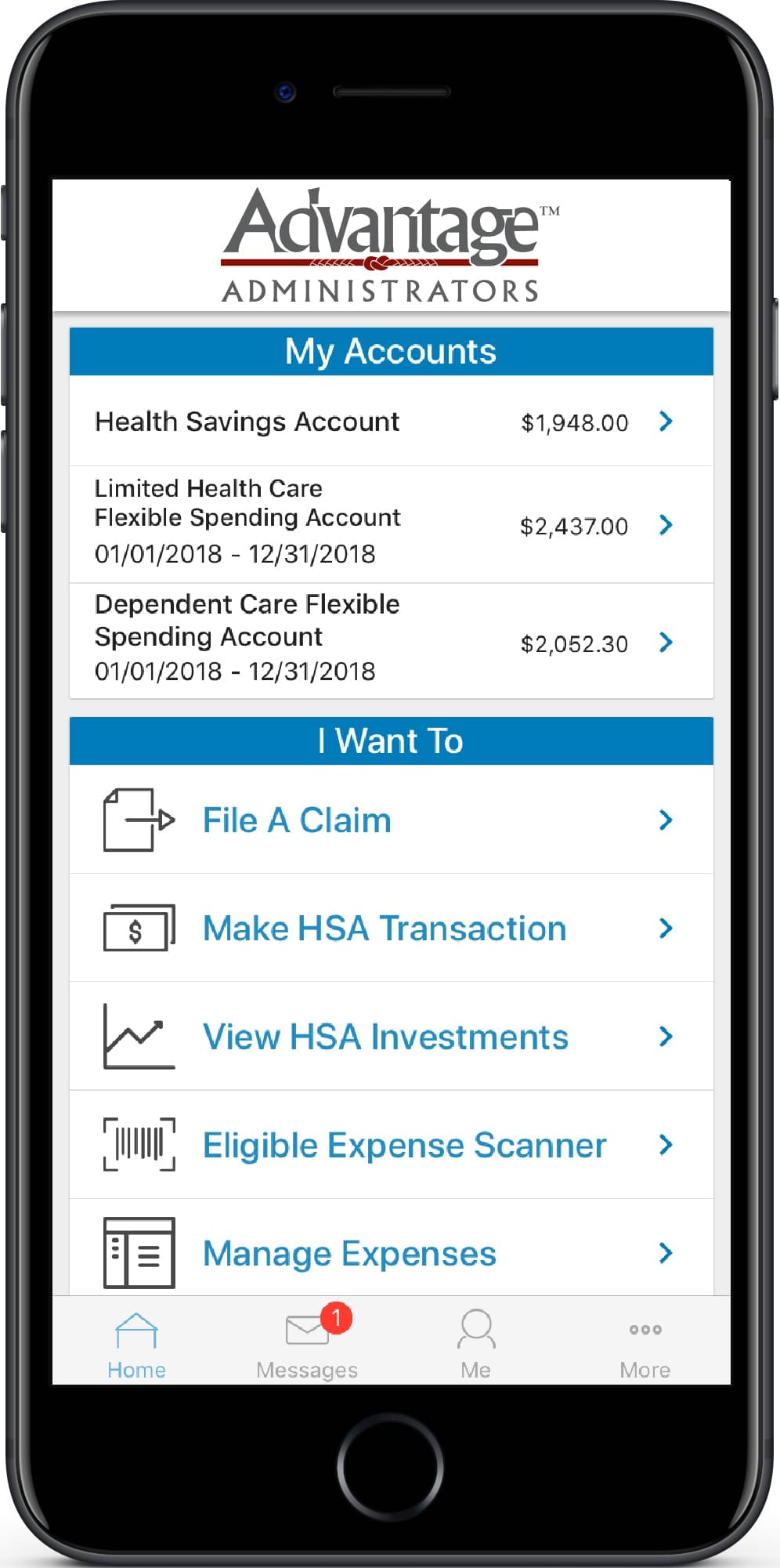

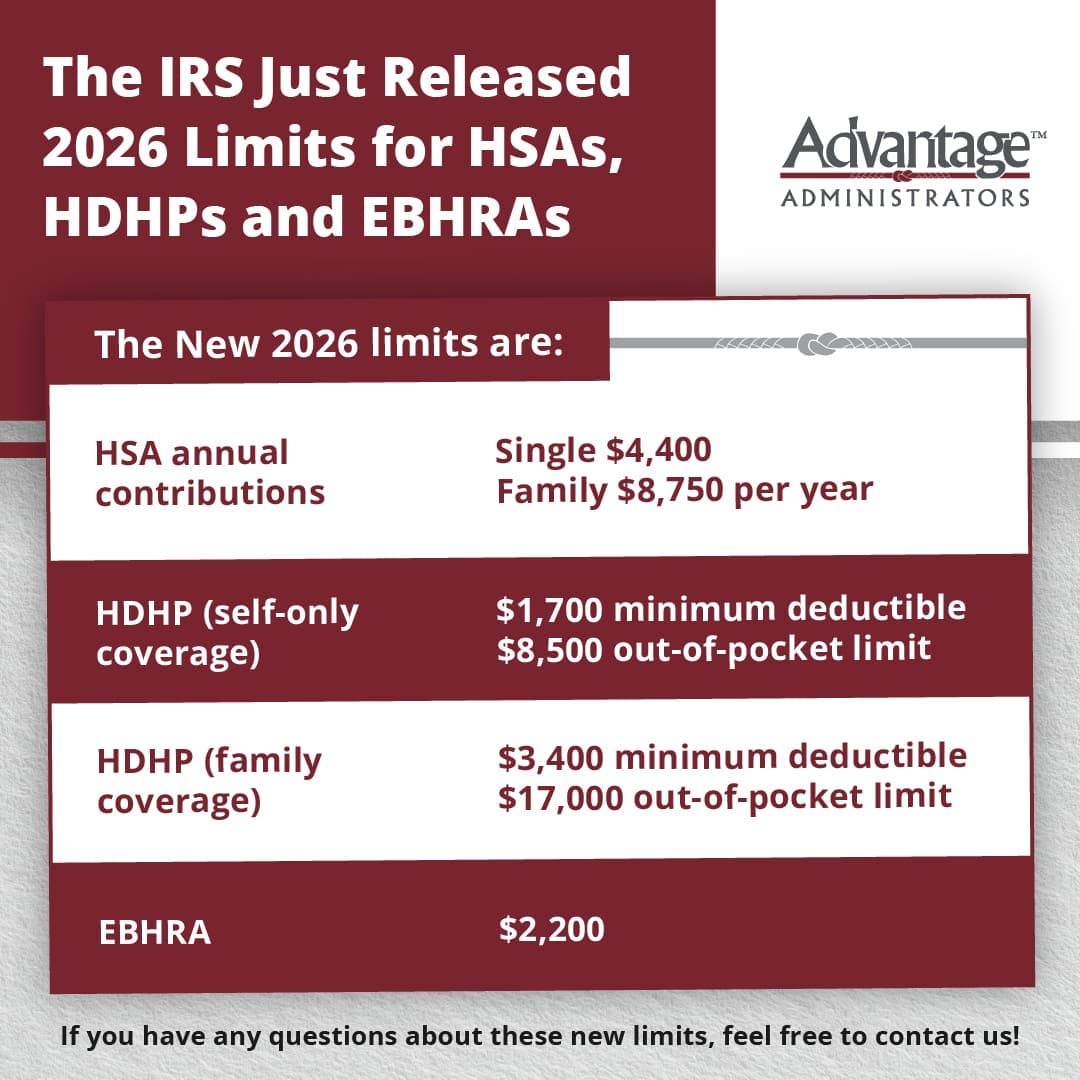

Forms HSA

HSA HRA

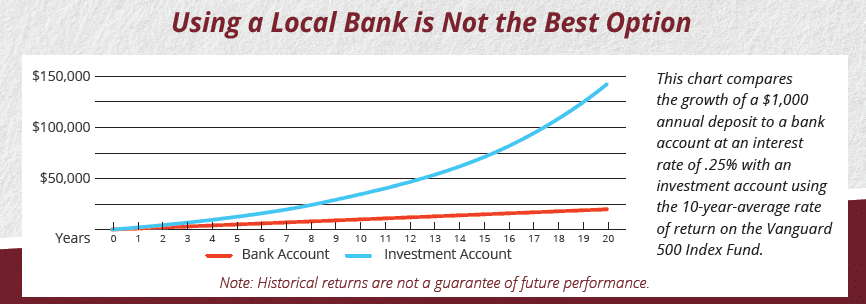

HRA Retirement

Retirement Health Shopper

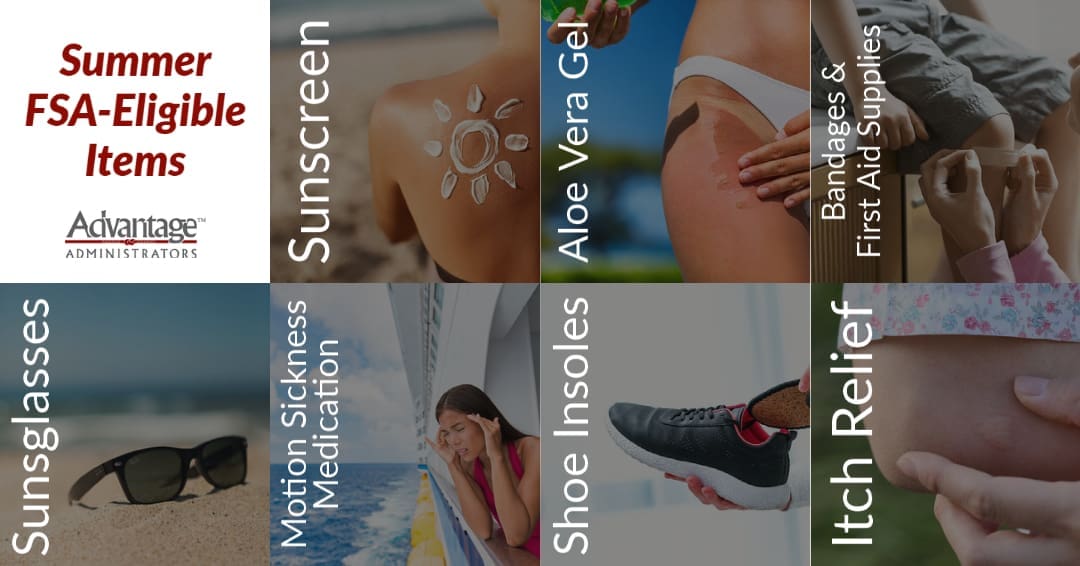

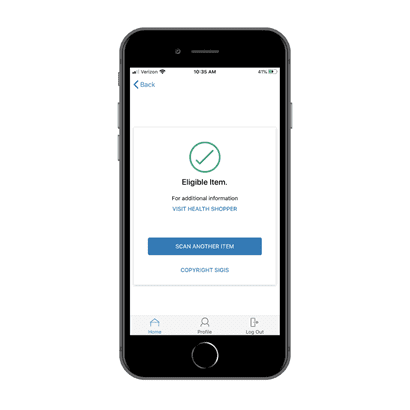

Health Shopper FSA Store

FSA Store