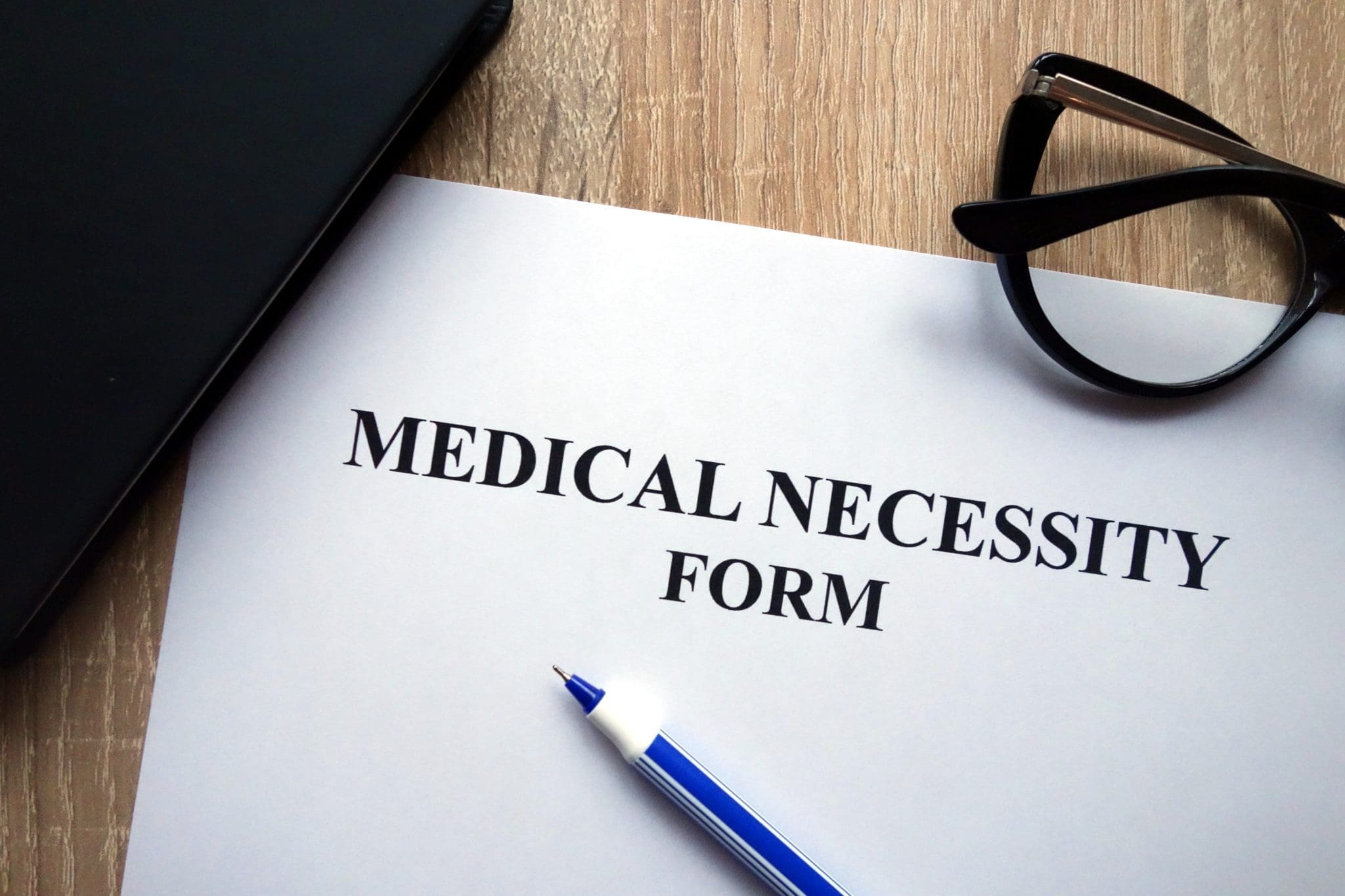

Why FSA Substantiation Matters and What to Look For

The IRS requires flexible spending account (FSA) participants to submit documentation to prove their purchase was an eligible expense. The IRS emphasized these requirements and potential penalties for employers not meeting the requirements when releasing an Office of the Chief Counsel memorandum detailing medical expense claim substantiation for medical FSAs and dependent care FSAs. That’s...

Flex Plans

Flex Plans Forms

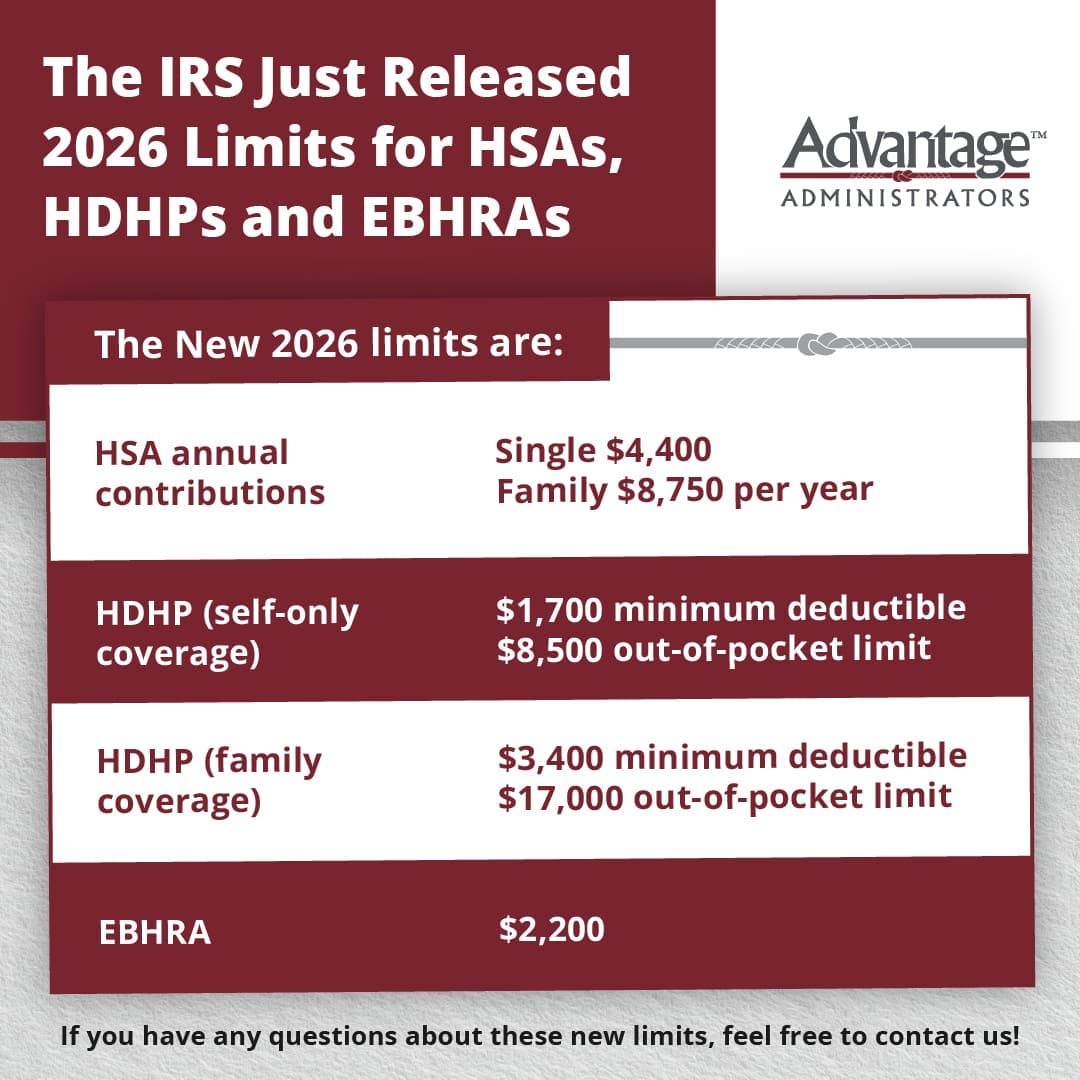

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store