The Affordable Care Act (ACA) Code Cheat Sheet You Need

The Internal Revenue Service (IRS) has two sets of ACA codes that help employers have a consistent way to illustrate their medical benefits to employees. Each code is unique and indicates a scenario about an offer of coverage or gives an explanation on why an employer should not be subject to penalty each month.

ACA 1095 Codes Cheat Sheet

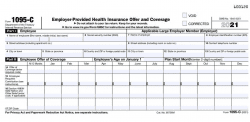

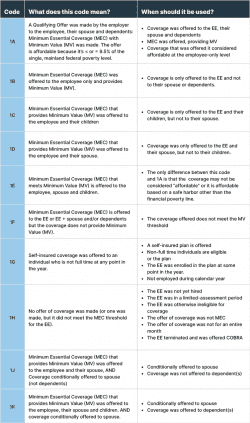

Form 1095-C: Line 14 – Code Series 1

Code Series 1 is used for line 14 of Form 1095-C and addresses:

- If an individual was offered coverage

- The type of coverage offered

- The months that coverage was offered

If an employee is benefit eligible at any month during the year, line 14 will include a value for each month, even when an employee is not/no longer employed.

Note: References to affordability relate to affordability for the employee-only coverage level. It does not matter if the employee elects coverage for themselves, a spouse or a dependent. The IRS is concerned only with what the employee would pay if they elected coverage for themselves alone.

*Offer of Coverage: An offer of coverage is one that provides coverage for every day of a calendar month. The exception is for terminated employees who would have been covered for the entire month if they were not terminated.

Form 1095-C: Line 16 – Code Series 2

The Code Series 2 is used for line 16 for form 1095-C and addresses:

- If the individual was employed and if they were full-time or part-time

- If the employee was enrolled in coverage

- If the employer is eligible for transition relief as an employer with a non-calendar year plan or a contributor to a union health plan

- If the coverage was affordable and if so, based on IRS safe harbor

The information in this blog post is for educational purposes only. It is not investment, legal or tax advice. For legal or tax advice, you should consult your own counsel. To stay up to date on benefits trends and insights, subscribe to our blog.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store