2023 HSA contribution limits increase considerably due to inflation

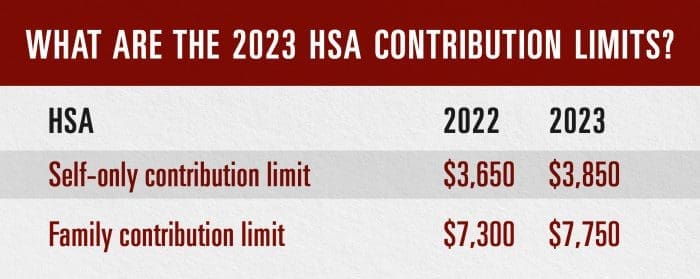

Health savings account (HSA) contribution limits will increase considerably in 2023. The IRS announced that 2023 HSA contribution limits will rise to $3,850 for self-only HSAs and to $7,750 for family HSAs. Those are increases of $200 and $450, respectively, from 2022.

The 2023 HSA limit increases are in response to our country’s recent spike in inflation, with rates increasing at a 40-year high.

The 2023 HSA limits were announced as part of Revenue Procedure 2022-24.

What are the 2023 HDHP amounts/limits?

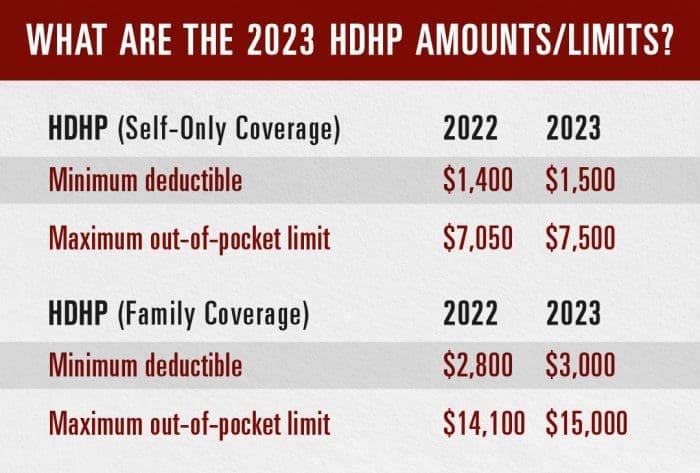

2023 high-deductible health plan (HDHP) amounts and expense limits have also increased by a much larger amount than what we have seen in recent years. The 2023 HDHP minimum deductible is $1,500 for self-only coverage and $3,000 for family coverage. The maximum out-of-pocket limits for 2023 are $7,500 for self-only and $15,000 for family.

What are the 2023 EBHRA limits?

For the first time since they were introduced in 2020, the excepted benefit HRA (EBHRA) limits for 2023 will increase.

When can HSA participants change their contributions?

HSA participants can change their contribution amount at any time. Please contact Advantage Administrators to discuss your current contribution.

Who is eligible for an HSA?

Your employees must be enrolled in an HSA-eligible health plan (or HDHP) to be eligible to participate in an HSA.

How do HSA catch-up contributions work?

HSA participants who are 55 years of age or older can contribute an extra $1,000 annually. That means these HSA participants eligible for catch-up contributions have 2023 limits of $4,850 for self-only and $8,750 for family coverage.

The information in this blog post is for educational purposes only. It is not investment, legal or tax advice. For legal or tax advice, you should consult your own counsel. To stay up to date on benefits trends and insights, subscribe to our blog.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store