HSA vs FSA: See How You’ll Save With Each

Participating in a health savings account (HSA) or flexible spending account (FSA) is a great way to save money. Below, we’ve outlined the key differences between an HSA and an FSA so you can see how they work, the advantages of each and why you should participate in them.

Health savings account

An HSA is an individually owned benefits plan funded by you or your employer that lets you save on purchases of eligible expenses. You must be enrolled in a high-deductible health plan (HDHP) to be eligible, which lowers your insurance premiums.

HSAs have a triple tax advantage, meaning distributions for qualified medical expenses and investment returns are tax-free and contributions are tax-deductible. HSA funds can be invested for potential growth.

Our HSA comes with a low investment threshold, and our online account and mobile app make it easy for you to make the most out of your funds.

Flexible spending account

An FSA is an employer-owned account that you use to set aside funds for qualified expenses. You can enroll in an FSA during open enrollment, when you’re hired or when you experience a status change, such as marriage or birth/adoption of a child. We offer four common types of FSAs:

- Medical FSA

- Limited Medical FSA

- Combination FSA

- Dependent Care FSA

You can save on eligible expenses with an FSA. For example, if one employee is enrolled in a medical FSA, he or she reduces the taxable income, which reduces the amount subject to Social Security and Medicare. You won’t need to pay Social Security or Medicare taxes on the funds going into the FSA.

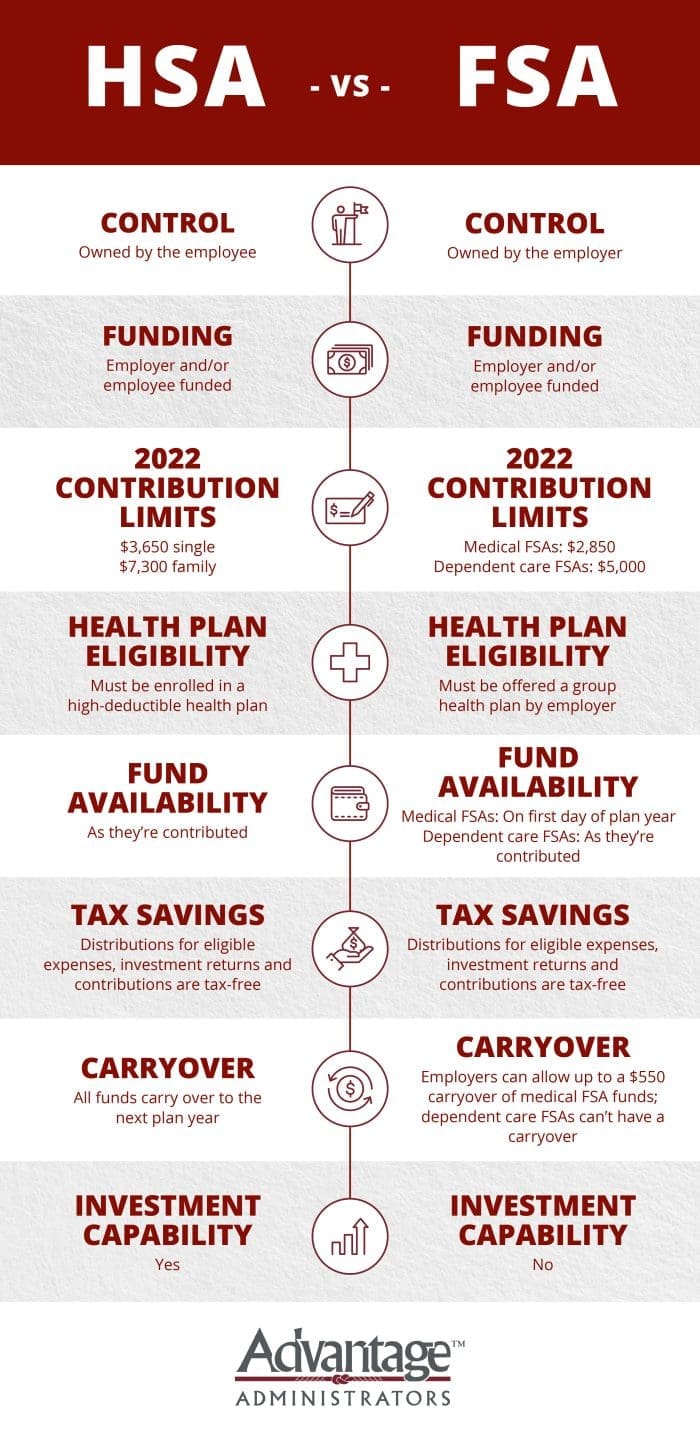

Key differences between HSAs and FSAs

- Ownership: You own your HSA. Your employer owns your FSA.

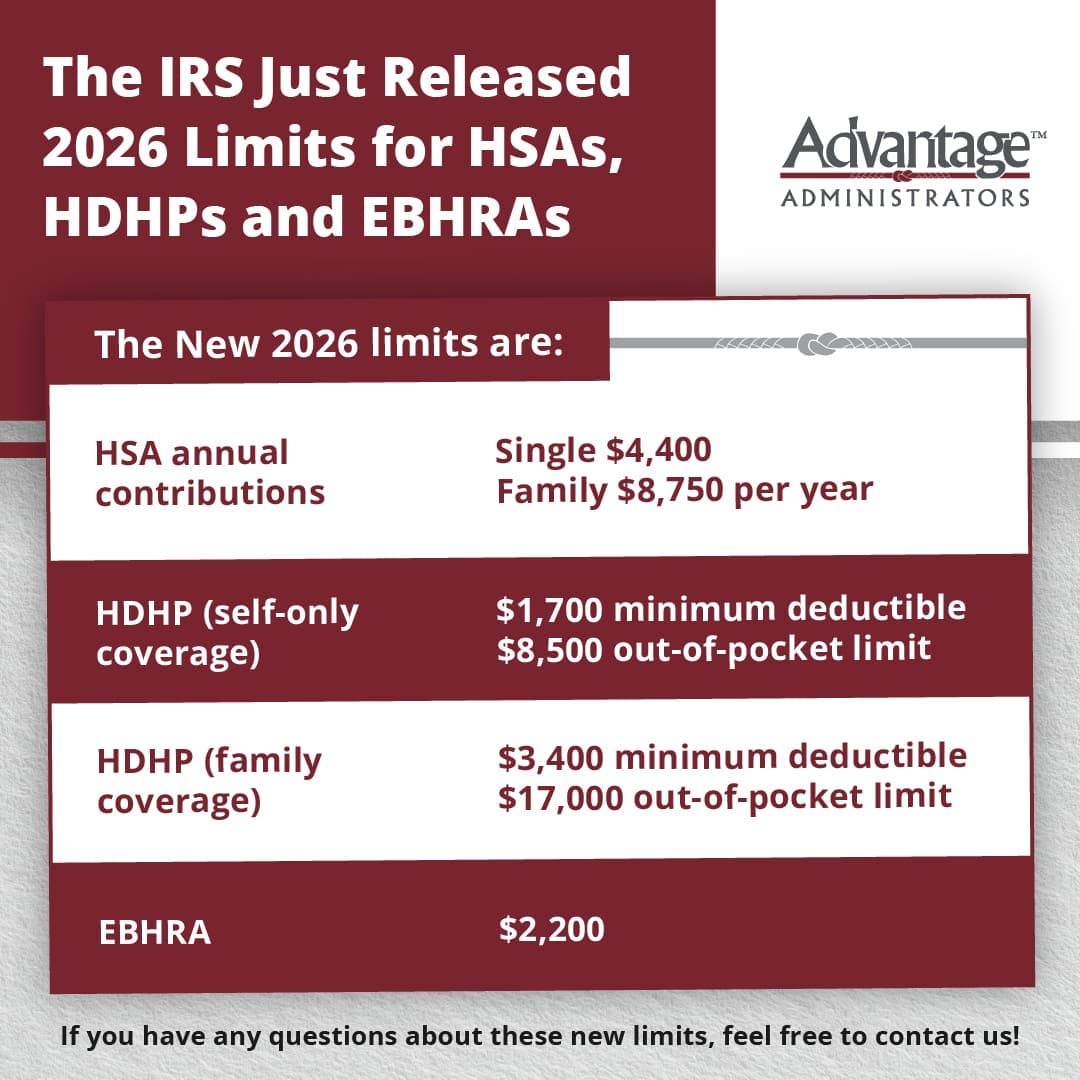

- Contribution Limits: The amount varies for each, as determined by the IRS. The 2022 HSA limits are $3,650 for self-only and $7,300 for family. The 2022 FSA limits are $2,850 for medical, limited and combination FSAs. For dependent care FSAs, the limit is $5,000.

- Health Plan Eligibility: HSA participants must be enrolled in HDHPs. FSA participants need to simply be offered a group health plan by their employer.

- Carryover: All HSA funds carry over from year to year. Employers can only allow up to a $570 carryover of medical FSA funds, while dependent care FSA funds do not carry over.

- Investment Capability: You can invest in HSA funds, but not FSA funds.

Can I have both an FSA and an HSA?

Yes, but there are restrictions. If you participate in an HSA, you can also participate in a limited medical FSA, a combination FSA or a dependent care FSA. You can’t participate in an HSA and a general-purpose medical FSA. There are perks to participating in both accounts.

Is an HSA or FSA use-it-or-lose-it?

The IRS’ use-or-lose rule states that FSA funds must be spent by the participant within the FSA’s plan year. That means FSA participants typically need to spend most or all their FSA funds by the end of the plan year. Unused funds at the end of the plan year are forfeited to the plan.

The use-or-lose rule doesn’t apply to HSAs. All HSA funds carry over from year to year.

Watch the below video from Wex’s Benefits Buzz podcast to hear from Rida Wong of Health-E Commerce about the primary differences between an HSA and an FSA.

Education is critical to get the most out of your employee benefits. Stay updated on the latest trends and insights by subscribing to our blog!

The information in this blog post is for educational purposes only. It is not investment, legal or tax advice. For legal or tax advice, you should consult your own counsel.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store