You Need $175K for Healthcare Retirement Costs. Here’s How an HSA Can Help.

Your mission: To build a nest egg of $175,000 for healthcare costs in retirement. How are you going to get there? Great question. It’s a big goal! But it’s achievable. We wanted to show you how you can get to that number exclusively by using your health savings account (HSA) as the savings tool it’s intended to be.

Why $175,000?

A recent study found that the average healthy 65-year-old couple retiring in 2020 “is projected to spend approximately $351,000 in today’s dollars ($535,000 in future dollars) on healthcare” in their lives. If a couple needs about $350,000, then an individual can expect to need half that — $175,000 — in retirement.

Why an HSA?

HSAs are booming in popularity, with total assets eclipsing $82 billion in 2020. That’s nearly triple from just five years earlier.

Unfortunately, many HSA participants use their HSAs exclusively as short-term savings vehicles. Only 41 percent of HSA participants save money in an HSA to prepare for retirement, while just 6 percent invest their HSA funds. That’s despite HSAs having comparable — or better — retirement-planning perks than 401(k) or IRA, including:

- HSA earnings through investment accumulate tax-free.

- All HSA funds carry over from year to year.

- Flexibility to withdraw funds for eligible expenses when needs emerge.

- Contribution amounts can be changed at any time.

Our HSA retirement model

We’ve developed a model to help you see how you can reach your retirement goals with an HSA. The model is based on the following:

- You invest your HSA funds, and the return-on-investment is 5 percent annually.

- Your combined federal and state tax rate is 25 percent.

Scenario #1: You’re 25 and are 40 years from retirement

As with any retirement planning, the earlier you start, the better. That will become very clear as you progress through these scenarios.

Based on our model, if you wanted to get to $175,000 in your HSA for retirement, you would only need to set aside about $18 per week. That’s well short of an HSA’s contribution limit (in 2021, it was $3,600 per year for individuals). To put it in perspective, $18 per week might be less than what you spend on coffee each week.

Scenario #2: You’re 35 and are 30 years from retirement

Thirty years still leaves you with a lot of time and wiggle room. By contributing just $33 per week to an HSA, you’ll be on the path to $175,000. That’s less than the average American spends on gas, motor oil, and other fuels in an average year.

Scenario #3: You’re 45 and are 20 years from retirement

Even at 20 years until retirement, $175,000 is still achievable within an HSA’s contribution limits. Within our model, you would need to contribute $65 per week to reach $175,000 by retirement. That’s less than the average used car payment, and the return is a lifetime of healthcare coverage after age 65.

Scenario #4: You’re less than 20 years from retirement

The good news is it’s not too late to get to $175,000! It will be a little more challenging to achieve this goal if you’re confined to self-only HSA contributions due to the IRS’ self-only limits. However, you have options:

- If you’re married and the HSA-eligible high-deductible health plan you’re enrolled in also covers your spouse, then you can contribute the HSA’s family contribution limit. That allows you to more aggressively pursue $175,000 with just an HSA.

- If you’re single and are confined to an HSA’s self-only limit, you can still max out your HSA. You’ll also want to turn to another retirement account to help you get to that number. But you should start with an HSA first, since there are tax advantages to using an HSA for healthcare costs that a 401(k) or IRA don’t have.

If you’re an employer and consultant interested in learning more about how HSAs can enhance your employees’ retirement-planning strategy, contact us today!

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

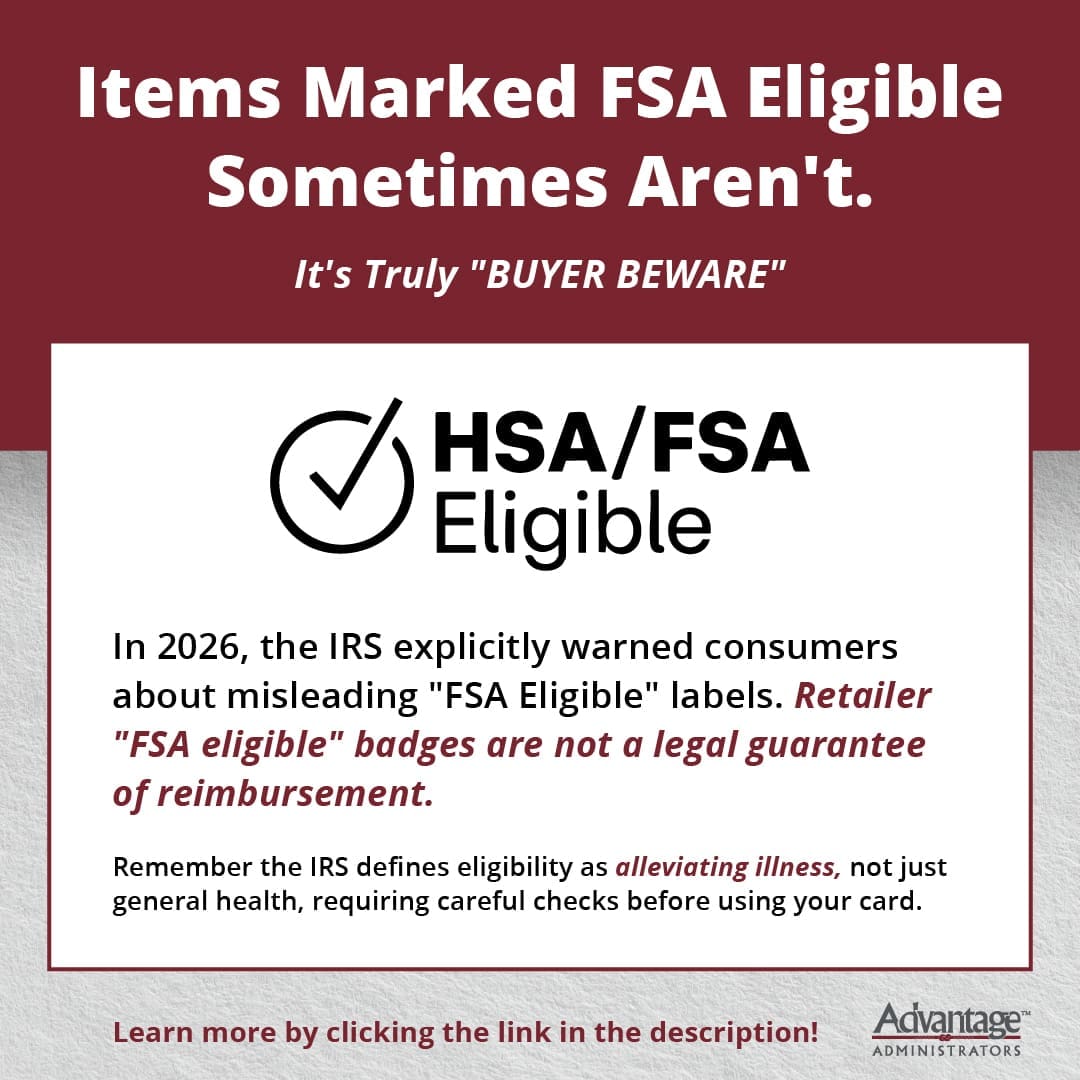

Health Shopper FSA Store

FSA Store