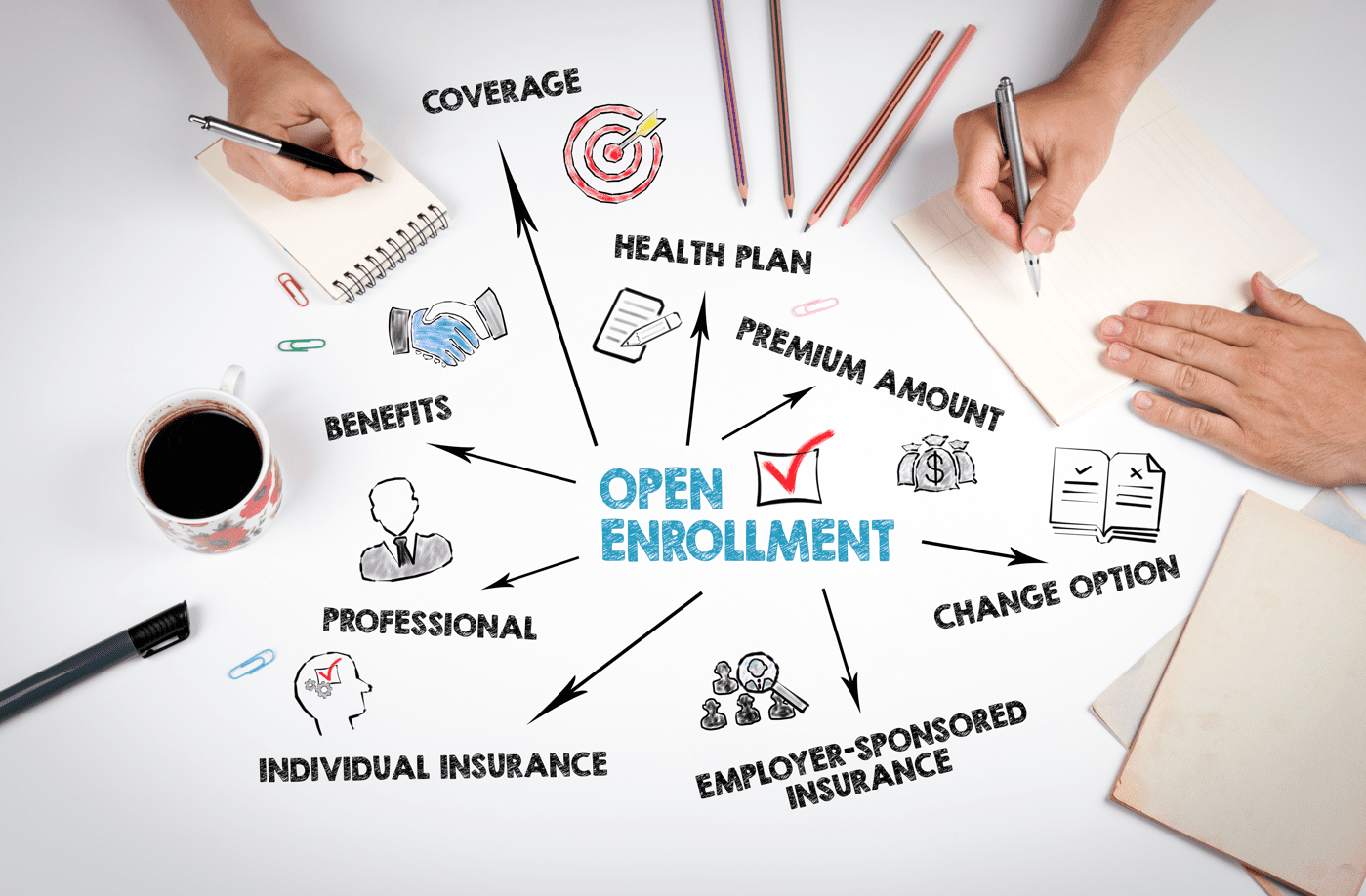

Advantage Administrators Open Enrollment

As the seasons begin to change and 2018 starts to wind down, we can start looking forward to the new year—and that means reviewing your benefits plan.

Every plan varies, but for many people, a Health Savings Account (HSA) and Flexible Spending Account (FSA) are the primary tools for tax-free medical financial planning. Advantage Administrators offers comprehensive HSA and FSA options with great customer service and a variety of no-fee services for more-complete, more-customized health benefits. Regardless of your individual situation, we can help you get ready for the 2019 benefits year, beginning with our quick benefits overview below!

Health Savings Account (HSA)

HSAs are excellent tools for directing tax-free dollars toward qualified out-of-pocket healthcare expenses. Under a qualified high-deductible healthcare insurance plan and up to a federally-defined maximum contribution level, individuals can set aside money to pay for upcoming medical expenses, making it convenient and cost-effective to budget and pay for everyday and even emergency healthcare costs. The account funds are available for reimbursement only as they are funded.

When considering appropriate contribution levels to your HSA, there’s a few important things to keep in mind. First, always remember that an HSA is a planning tool—any amounts you contribute are intended to cover eligible, anticipated medical expenses. This means that to maximize the benefits of your HSA, you should identify likely expenses and base your contribution levels on those costs. You should also plan on contributing in excess of this anticipated expense amount, given that HSA funds roll over annually. This allows you to access money that you placed in your HSA in an earlier year without negative tax consequences, all for healthcare expenses you are paying anyway. Participants of some plans also have Limited Health Flexible Spending Accounts (Health LFSAs), which are used with an HSA and allow for defined amounts of contributions toward dental and vision expenses. All of this is why, for many people, HSAs are a win-win!

Ready to start your 2019 HSA planning? Check out our HSA Goal Calculator!

Flexible Savings Account (FSA)

With an FSA, participants can set aside dollars each year from their paycheck to pay for qualified health and dependent care expenses through a Section 125 Cafeteria account. The funds are available on day one of the plan year. As a bonus, FSA contributors also benefit from the increase in take-home pay resulting from the deduction of these amounts from their wages prior to the payment of income and social security taxes. Employers are also not required to pay FICA or FUTA taxes on dollars in their employees’ FSA plans. Additionally, users can access a reimbursement account during the year to pay for qualified expenses.

One important difference with FSAs versus HSAs is that FSA contributions that are not used don’t carry over at the conclusion of the plan period. Given this, it’s critical that you structure your FSA contributions based only on your level of likely expenses in the upcoming plan year, which you should carefully sketch out before your plan year begins. While certain plans allow for a $500 rollover in FSA funds from year-to-year, this feature of FSA accounts makes them less apt for long-term planning and more appropriate as a source for immediate medical expense needs.

One helpful tool to use when planning for your FSA contributions for 2019 is our Employer Benefit Plan Calculator. It helps you identify your healthcare-related expenses, such as health insurance, and contributions levels for HSAs and FSAs, helping you to see your whole plan year in one snapshot. Give it a try!

Is Your Benefits Plan Ready for 2019?

Have questions about your benefits? Need assistance planning for the future? The experienced, helpful benefits professionals at Advantage Administrators would be glad to discuss your individual situation and help you create a 2019 benefits plan that works for you. Contact us today

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store