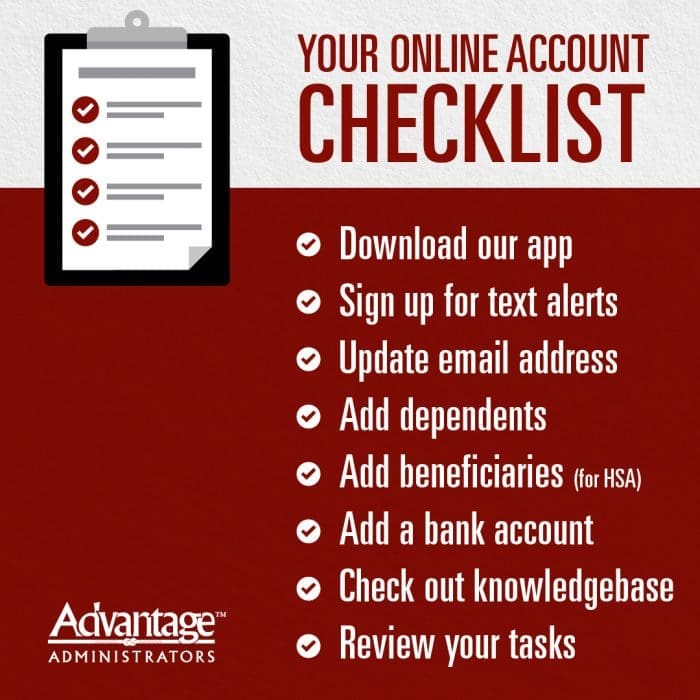

Start Your New Benefits Plan Year Off Right with These 8 Tips

For most of you, a new plan year has begun! Just because you have an entire plan year ahead doesn’t mean you should wait until November or December to put time and energy into your employee benefits. In fact, staying on top of your health savings account (HSA), flexible spending account (FSA), or any other plan you signed up for throughout the year can pay off for you. We’ve compiled some tips to help you if you participate in an Advantage Admin benefits plan.

Download our app

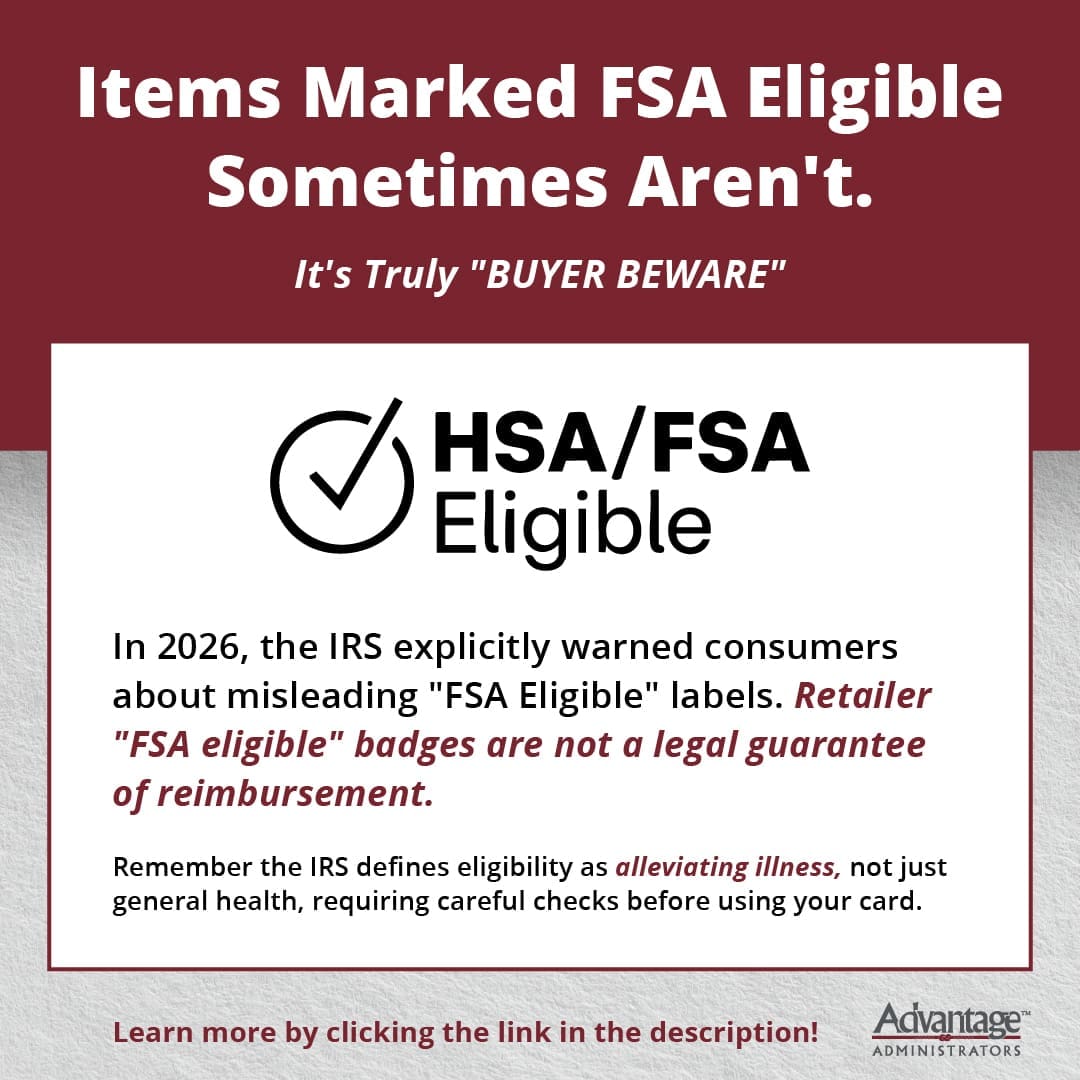

A variety of day-to-day expenses are eligible for your HSA and FSA funds, including over-the-counter expenses. Having your employee benefits anytime you need them isn’t just comforting. It’s an expectation. If you participate in an HSA, FSA, HRA, LSA, or commuter benefits with us, download the benefits mobile app to check your balance, file claims, upload documentation, and even use the scanner to check products for eligible expenses.

How do you do this? Go to the Apple or Google Play store and search “Advantage Admin.” It will be one of the first apps you see after that.

Sign up for text alerts

Statements. Contributions. Debit card activity. There are a variety of activities related to your account that you want to stay on top of by signing up for text alerts.

How do you do this? From your online account, click on Message Center and then click Update Notification Preferences. In this menu, you can also add your phone number and email address for your account.

Update email address

If you completed the previous task of signing up for text alerts, you may have noticed that there are a variety of email notifications also available, including notifications for your HSA account summary or debit card activity. Plus, going paperless is great for the environment! You’ll want to make sure you have the right email address on file when signing up for these.

How do you do this? From your online account, hover over Accounts and click on Profile Summary.

Add dependents

Your HSA or FSA may cover your dependents’ costs if the dependents are claimed on your tax return.

- For medical FSAs, expenses for children through age 26 and spouses are permitted.

- For dependent care FSAs, it’s generally used for dependent children through age 12 (or spouses or adult dependent children who are physically and mentally incapable of self-care).

- For HSAs, expenses for tax dependents and spouses are covered.

How do you do this? From your online account, hover over Accounts and click on Profile Summary.

Add beneficiaries (for HSA)

An HSA is all yours. Your balance rolls over from year to year, and the account stays with you even if you change jobs. Because an HSA is a “savings” account, you’ll want to designate a beneficiary (or beneficiaries), just as you would with a 401(k) or other retirement-planning accounts.

How do you do this? From your online account, hover over Accounts and click on Profile Summary.

Add a bank account

When you pay out of pocket for HSA or FSA eligible expenses, you want to be reimbursed fast! By adding a bank account to your account, your HSA and/or FSA can reimburse you for out-of-pocket expenses through direct deposit, which is a faster way to be reimbursed.

How do you do this? From your online account, hover over Accounts and click on Banking/Cards.

Check out our knowledge base

If you want to know the answer to something, you can search for it online. Your employee benefits experience should be the same way. We developed our knowledge base with that in mind, so you can easily find answers to questions you have about HSAs, FSAs, commuter benefits, and more!

How do you do this? Click “Get Help” within your online account to view our knowledgebase of help articles. Search for what you need, or peruse articles based on topic.

Review your tasks

The Tasks menu will let you know of any actionable items, such as setting up a bank account for direct deposit and the need to upload documentation for an outstanding FSA claim.

How do you do this? Right after you log in to your online account or the benefits mobile app, you’ll see a “Tasks” menu.

Education is critical to get the most out of your employee benefits. Stay updated on the latest trends and insight by subscribing to our blog!

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store