Top 5 Misconceptions about HSAs and FSAs –And What to Say to Correct Them

For most people, the idea of a health savings account (HSA) or flexible spending account (FSA) can appear confusing, if not a little intimidating. What are they? What types of expenses do they cover? When? Are there any limitations? Can I carry my money over every year? Who owns the account?

Getting those HSA and FSA basics down are important. An HSA is an account that works only with a high-deductible health insurance plan and also has several appealing features:

- It allows you to pay for a variety of medical expenses, including doctor’s office visits, certain prescriptions, eyeglasses, babysitting expenses, and more.

- You can also contribute to an employer-sponsored HSA with pre-tax dollars from your paycheck for even greater savings, and your HSA money rolls over every year.

- Along with offering a triple tax savings (tax-free contributions, earnings, and withdrawals for qualified expenses), participants can begin investing through an HSA once it hits a threshold amount.

- You have your choice of payment: pay with an HSA debit card or get reimbursed later. Currently, the IRS allows you to reimburse yourself at any point in the future, so it’s critical to keep your receipts! Please note, however, that you cannot use your HSA to pay for expenses incurred before you enrolled in the HSA.

- Your HSA is employee-owned, so if you change jobs, the account moves with you.

Unlike an HSA, you can enroll in an FSA with most types of health insurance plans. These accounts offer similar benefits with a few key differences:

- FSA funds can also be spent on many different healthcare items, including prescription medications, dental visits, vision care, and health insurance deductibles, coinsurance, and copays.

- Like an HSA, an FSA allows a participant to contribute pretax money. Unlike an HSA, that money doesn’t initially come from the employee’s paycheck but from the employer, who first funds the account at the level the employee selected (up to the IRS-determined limit). As the year goes on, that money is deducted from the employee’s paycheck until it is fully funded from that source once the new plan year begins.

- Money that you deposit and the amounts you use to pay healthcare expenses are nontaxable.

- FSA reimbursement for expenses can be completed through a debit card or by submitting a claim for reimbursement. Because your FSA dollars expire at the end of the plan year, it is advisable to seek reimbursement as soon as possible.

- Changing careers will end access to your FSA, because the account is employer-owned.

Ok, so now you know what an HSA and FSA are and what each does. But do you know how to best use yours? According to a recent report by WEX Health, confusion over health insurance has led many Americans to misunderstand the best way to use their HSAs and FSAs. Here are some of the common misconceptions about these accounts as well as the truth:

- Myth #1: If you don’t use your HSA money, you lose it. Unlike an FSA, in which any additional funds left over disappear at the end of the plan year (beyond those you can roll over and/or have used in a grace period, each only as allowed by your employer), all of your HSA funds roll over each year. That’s why it’s critical to use your FSA for immediate and common medical expenses and to treat your HSA as a retirement account and a last-resort source of healthcare funds.

- Myth #2: It’s pronounced “health SAVINGS account”, not “health SPENDING account”. For too many participants, an HSA is an easy and quick way to pay some of their everyday medical expenses. And that’s understandable, given the ever-increasing cost of healthcare in America. But utilizing your account primarily as an investment vehicle (rather than to pay for routine health expenses) is the key to maximizing your HSA. With this approach, you can enjoy the long-term advantages of a professionally invested account (see Myth #3 below), which will reap additional benefits once you reach age 65, as you can then spend that money for any purpose (even non-medical ones).

- Myth #3: You only need an HSA or FSA if you’re older or sick. Contrary to a widely-held opinion, having an HSA and/or FSA is a good idea for anyone, regardless of their age or health.

When used primarily for retirement planning, your HSA has the potential to outperform other standard savings vehicles. While historical returns are not a guarantee of future performance, past statistics show an HSA producing a 31% increase in purchasing power at retirement versus a Roth IRA or 401(k). $1,000 deposited annually into a Vanguard mutual fund has been shown to produce a greater rate of return at 10- and 20-year periods versus putting that money into a bank account that earns a .25% interest rate. Simply put, an HSA is an outstanding investment vehicle.

But maximizing your HSA’s potential requires spending discipline. Other than in emergency situations, you should avoid paying medical expenses using HSA funds. Instead, you should turn to your FSA for all routine healthcare costs. This is particularly true given the use-it-or-lose-it policy that causes the account’s funds to disappear at the plan year’s end. While many people may find it difficult to budget for healthcare expenses by setting each year’s account contribution level in advance, putting aside money for planned medical care can stop you from needlessly draining your HSA for every doctor’s appointment and prescription.

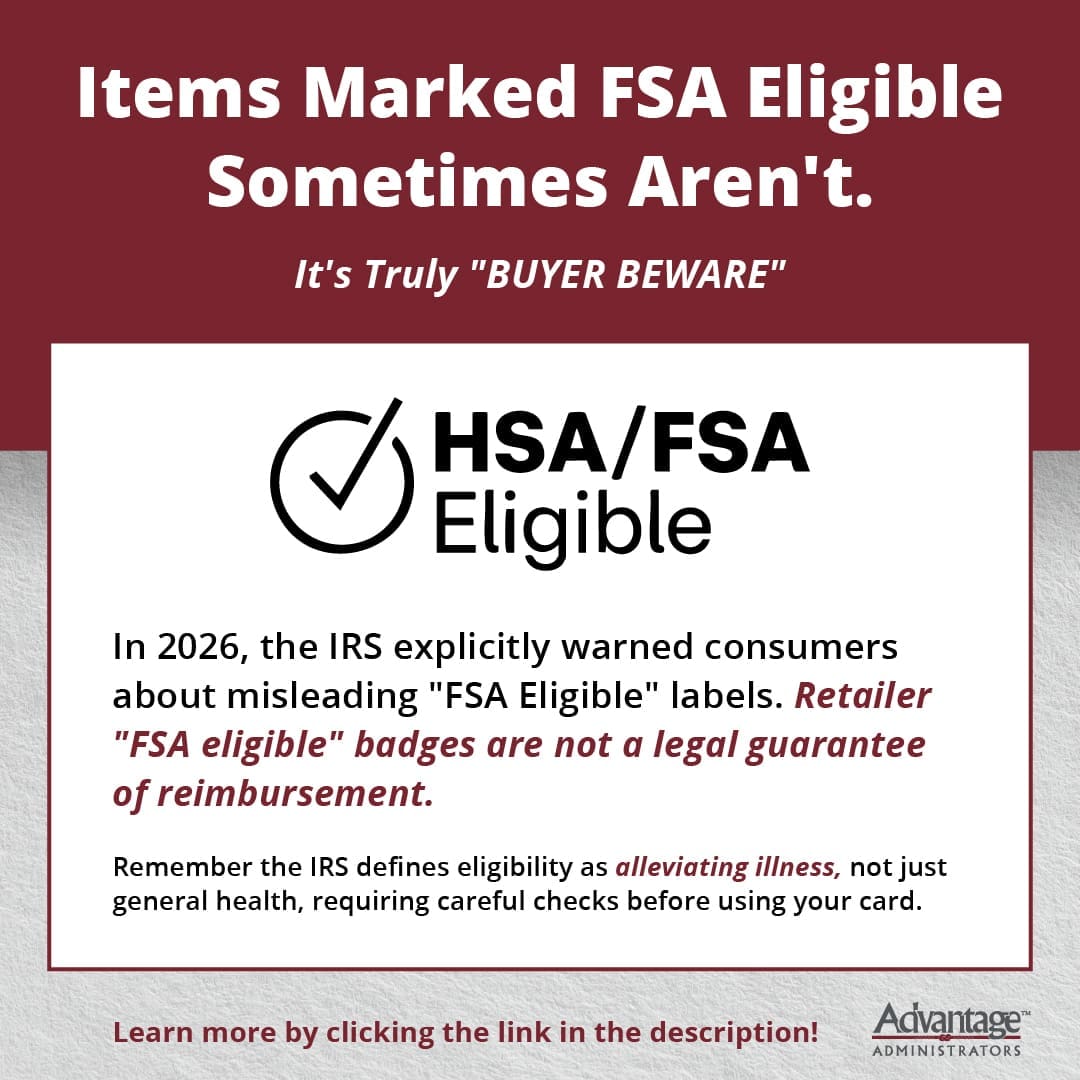

- Myth #4: HSAs and FSAs are limited to doctor’s and hospital expenses. Acting upon this myth can significantly limit your account’s usefulness. Contrary to popular belief, a wide variety of expenses are eligible to be covered with HSA and FSA funds, including amounts you pay out-of-pocket when you use your health insurance, over-the-counter and prescription medical supplies and medications, and an array of other wellness services and items. The list of eligible expenses, which the IRS determines annually each year, covers many everyday health needs and, when you cover health expenses with your FSA and invest with your HSA, you’re maximizing both accounts and planning wisely for the future (see Myths #2 and 3 above).

- Myth #5: You can invest using HSA or FSA funds. Only your HSA funds (once you’ve cleared any applicable threshold amount established by your administrator) can be invested.

That’s a lot of myths and a lot of truth all in a small space. Just remember: while healthcare, and life, can be expensive, you have two powerful tools in your corner when you open an HSA and FSA. At Advantage Administrators, we can help you get the most out of your accounts, whether you only need an annual checkup or are managing a chronic disease, and whether you are 27 or 64. To get started, give us a call or visit our website today!

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store