4 Ways to Use HSAs to Achieve Your Financial Goals

We are a few months into the new year and for most Americans, a new year means setting new financial goals. In fact, almost three-quarters of U.S. citizens had a New Year’s resolution last year that centered on being smarter with money.

So, how can you do just that? We broke down a few ways below or you can watch an episode of Benefits Buzz podcast to learn more.

Max out HSA contributions

There is no “one-size-fits-all” guidance on how much you should be contributing to your health savings account (HSA). With rising healthcare costs and the cost of living, saving for retirement is more important than ever. Since all funds carry over, you don’t risk losing funds at the end of the plan year. This is one reason why it makes sense to max out your HSA contributions in line with the IRS limits.

Our HSA Goal Calculator can help you determine the right contribution amount based on your goals. It provides personalized calculations so you can learn more about your HSA’s present and future potential. Simply by entering basic information, the HSA Goal Calculator helps calculate your future savings balance, potential retirement balance, and projects how different levels of contributions can make an impact.

Set and monitor savings goals

Setting goals that are achievable is vital to securing your dream retirement, but so is monitoring those savings goals. Always remember that your HSA contribution amount is flexible and can be changed at any time during the plan year.

At the 90-day mark, it’s clear whether you are making the right moves to meet your financial goals. It’s important to review your savings goals for the year one by one and to be honest with yourself on your progress.

- For goals you may have missed, it helps to figure out what may have caused you to miss them. Have you saved as much as you wanted to? Did you make the payments you planned to make? Did you reduce certain expenses in ways you aimed to?

- For goals you’ve hit, it can help to see if you have the capability to be more aggressive with them. If you have more money left at the end of the month than anticipated, how can you allocate it to other areas of your life?

Invest your HSA funds

Investing your HSA funds can enable your money to grow faster, tax-free, and help supplement your long-term needs while you save for retirement. However, most people with active HSAs don’t take advantage of investing their money. In fact, only 6% of account holders invested their HSA balance in 2020.

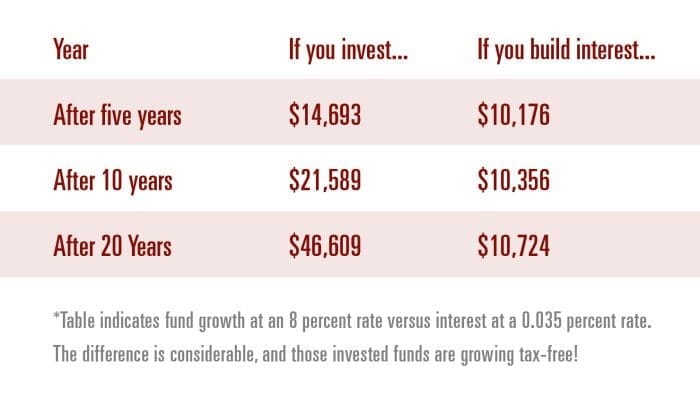

The expected rate of return on mutual fund investments is much higher than the standard interest rate of an HSA. For example, let’s say that you have $10,000 in your HSA balance and are trying to decide if you should invest your dollars. The chart below shows how this money would build interest over time.

Evaluate HSA and 401(k) together

Many people dream of a certain retirement lifestyle. These goals are achievable, especially with the right planning. Many don’t realize that HSAs and 401(k)s can be used together as a retirement savings strategy. This pairing helps expand your savings potential over time.

- An HSA is a tax-advantaged savings account for current or future medical expenses. All funds roll over from year to year, and you can invest these funds. That makes these accounts ideal for retirement planning. They even have perks that a 401(k) or IRA don’t have, as it pertains to healthcare costs in retirement.

- The 401(k) has long been a retirement-planning staple. You can take advantage of tax savings (either pre-tax or post-tax) when you set aside dollars in a 401(k) for future use. These funds are then invested for potential growth.

Education is critical to get the most out of your employee benefits. Stay updated on the latest trends and insight by subscribing to our blog!

The information in this blog post is for educational purposes only. It is not investment, legal or tax advice. For legal or tax advice, you should consult your own counsel.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store