Last-Minute Ideas for Spending your FSA Funds

Since flexible spending accounts (FSAs) are governed by the IRS’ use-it-or-lose-it rule, any unused funds that remain in your account at the end of the year may be forfeited — with some exceptions, like if your FSA includes a carryover or grace period. It’s estimated that $1 billion of unused medical FSA funds will be forfeited this year alone. That’s a staggering amount! Fortunately, if your FSA has a grace period, you may still have time, to incur expenses and spend your 2021 balance. We’ve got you covered with a few tips below on how to use your account balance.

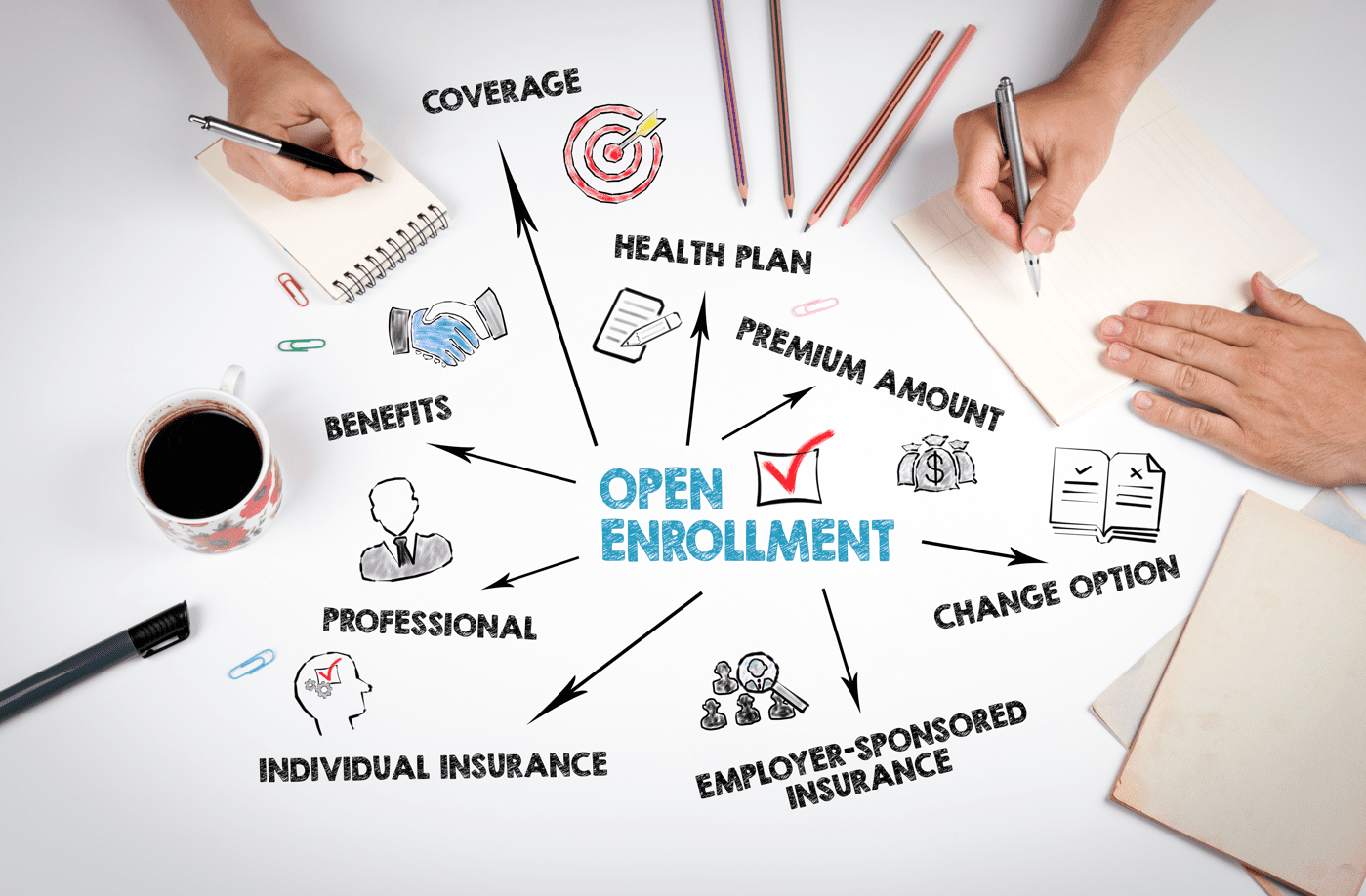

Review if your FSA has a carryover or grace period

An FSA carryover lets you carry a pre-determined number of dollars (the IRS allows a $570 maximum) to the next plan year. A grace period lets you spend your funds after the plan year has expired for a pre-determined amount of time. If your plan has neither, it’s crunch time!

Review your medicine cabinet

How is your supply of bandages? Do you use an over-the-counter nasal spray or eye drops? There are hundreds of common household items that qualify as FSA-eligible items. If you’re curious about the eligibility of a certain household item, look for it in our searchable list of eligible expenses.

Schedule a dental cleaning, eye doctor appointment or physical

It’s recommended that you have your teeth cleaned twice a year and have your eyes checked every two years (or annually, depending on your age). Maybe it’s simply time to get in your annual physical. If you’re due for a checkup, get in before the end of your plan year and use your FSA funds to cover eligible costs.

Schedule a chiropractor or acupuncture visit

FSA funds cover acupuncture appointments and many types of chiropractic care. With chiropractic visits, only adjustments are considered a qualifying expense. Some chiropractors also provide massage therapy, which can qualify as an eligible expense, but only if recommended by a physician to treat a specific medical condition. Documentation for massage therapy might be required.

Plan ahead for upcoming vacations

Do you have any vacations planned? Many common travel and outdoor expenses, such as first-aid kits, sunscreen and bug spray, can be purchased using your account dollars. (Note: For sunscreen to qualify, it must be SPF 30 or higher.)

Check your baby supplies

If you have a little one at home, there are several products you may be able to pay for with FSA dollars. Breast pumps and any supplies that assist lactation, such as bottles and storage bags, can be purchased with pre-tax funds. Prenatal vitamins and baby thermometers are also qualified expenses.

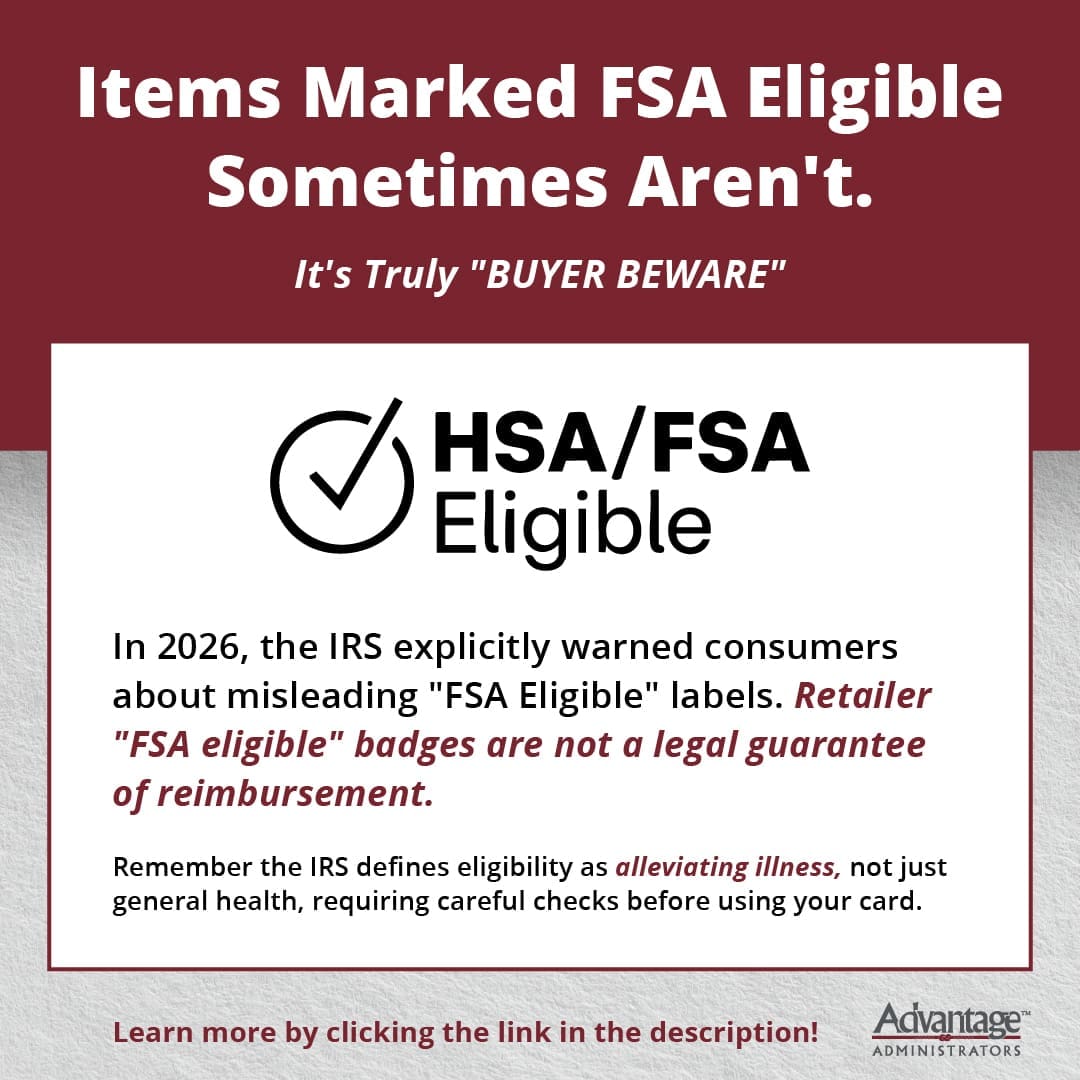

If you still have leftover funds, head over to the FSA Store, where you can find hundreds of eligible items and pay for them with your account dollars without ever leaving your house.

Education is critical to get the most out of your employee benefits. Stay updated on the latest trends and insights by subscribing to our blog!

The information in this blog post is for educational purposes only. It is not investment, legal or tax advice. For legal or tax advice, you should consult your own counsel.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store