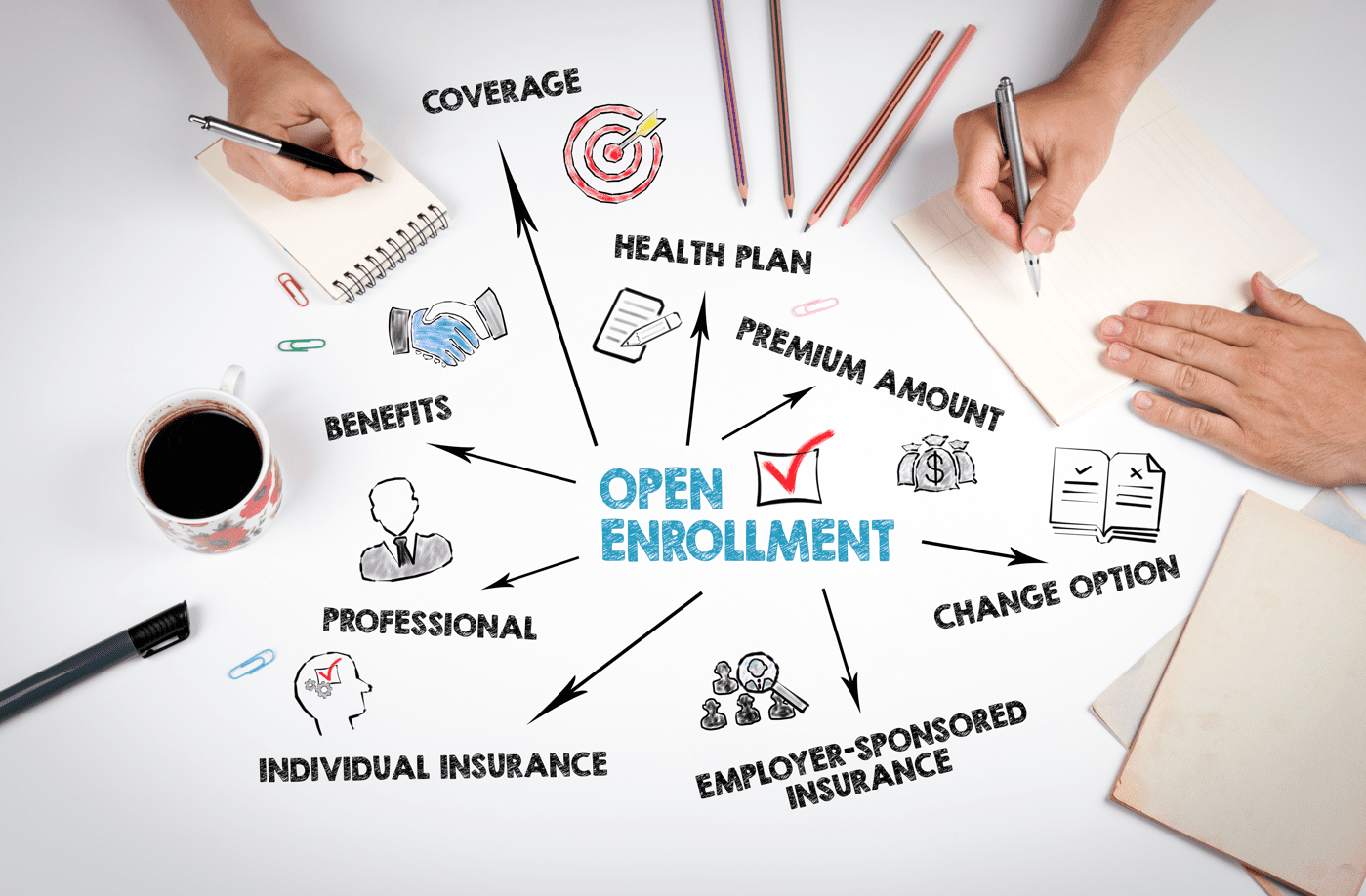

Save Money With Our Favorite Employee Benefits

Employee benefits can be complicated. You might be tempted to come into this open enrollment season ready to sign up for the same package as last year just to make it quick and painless. However, doing that may mean missing out on significant savings. Here, we’ll explain some of the most popular employee benefits and what they can do for you.

HSA

If you opt for a high-deductible health plan (HDHP), you will be eligible for a Health Savings Account, or HSA. You can contribute a portion of your paycheck, pre-tax, to this account, which can be saved or used for eligible medical, dental, and vision expenses. Your employer also has the option to contribute to your HSA.

HSAs have several advantages for participants.

- They offer triple tax savings- contributions, earnings, and withdrawals are all tax-free.

- HSA funds can be invested and are proven to perform as good or better than traditional investment accounts, such as a 401(k) or an IRA.

- HSA funds roll over year-to-year, and the funds never expire. You can use your funds for medical expenses now, or save it for later.

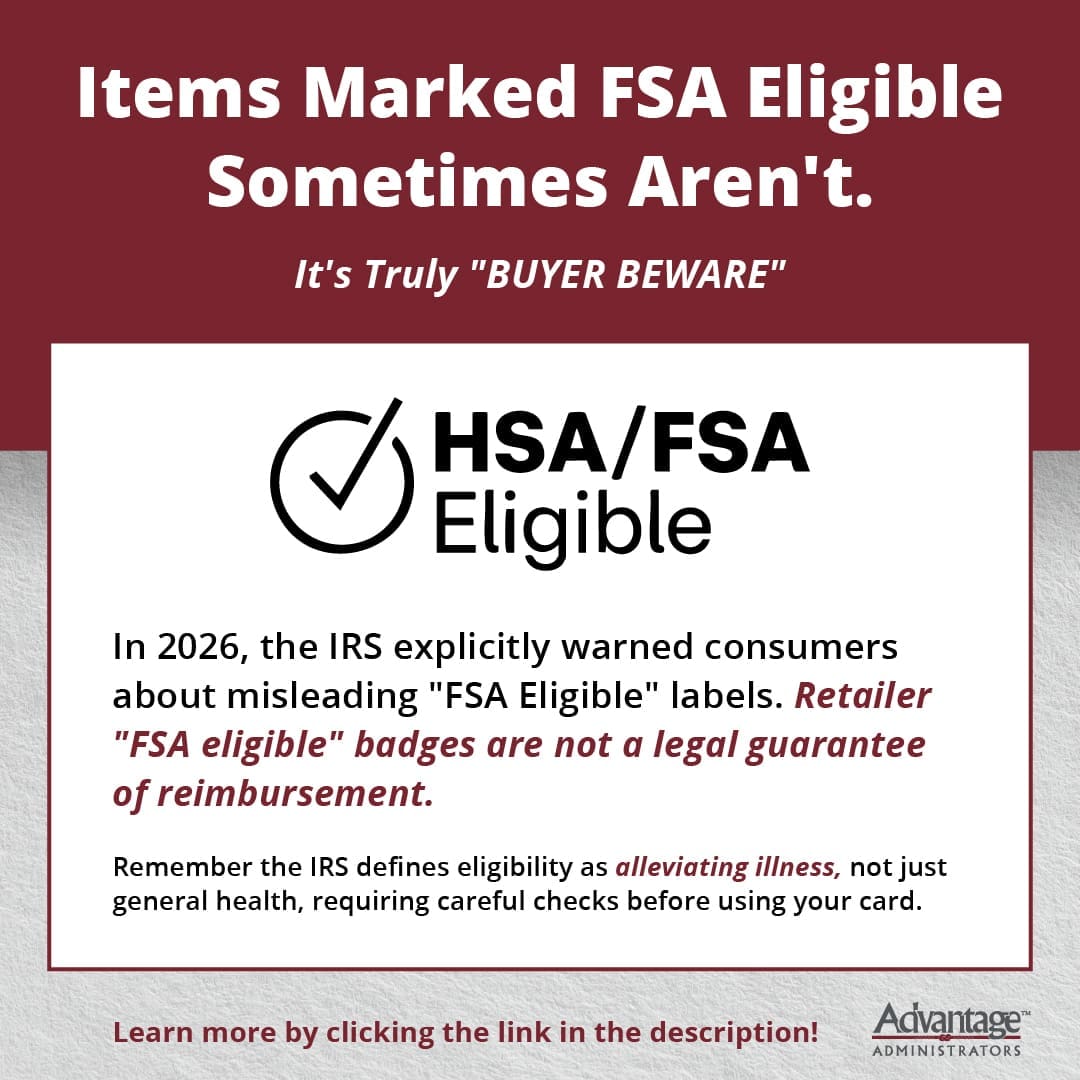

FSA

Flexible Spending Accounts, or FSAs, are similar to HSAs, but with a few notable differences. With an FSA, you also contribute pre-tax earnings to be used for eligible expenses. FSAs do not require an HDHP.

FSAs are not a savings account like an HSA. Therefore, funds must be used before the end of each year. However, employers have the choice to either add a two-and-a-half-month grace period after the end of a plan year, or a rollover. The rollover amount allowed for 2021 is $550. Employers need to contact Advantage Administrators to add one of these options to their plan.

There are several types of FSAs: general-purpose medical FSAs, limited-purpose medical FSAs, combination medical FSAs, and dependent care FSAs. Each of these has different rules. General-purpose medical FSAs cannot be used in conjunction with an HSA, but the other three can.

The two most common FSA plans are the general-purpose medical FSA and the limited-purpose medical FSA. With a general-purpose medical FSA, funds can be used for any eligible medical, prescription, dental, or vision expense.

You can use funds from a limited-purpose medical FSA only on eligible dental and vision expenses. This benefit can be used in conjunction with an HSA.

HRA

A health reimbursement agreement, or HRA, is a plan funded by employers which reimburses employees for out-of-pocket medical expenses. These plans are customizable by the employer, so it’s important to get information about the plan before enrolling in it.

Commuter Benefits

Some employers choose to offer commuter benefits, which can help pay for costs such as public transportation, vanpooling, and parking. Commuter benefits are funded by pre-tax employee dollars.

For questions about these, or any other employee benefits, contact Advantage Administrators.

Flex Plans

Flex Plans Forms

Forms HSA

HSA HRA

HRA Retirement

Retirement Health Shopper

Health Shopper FSA Store

FSA Store