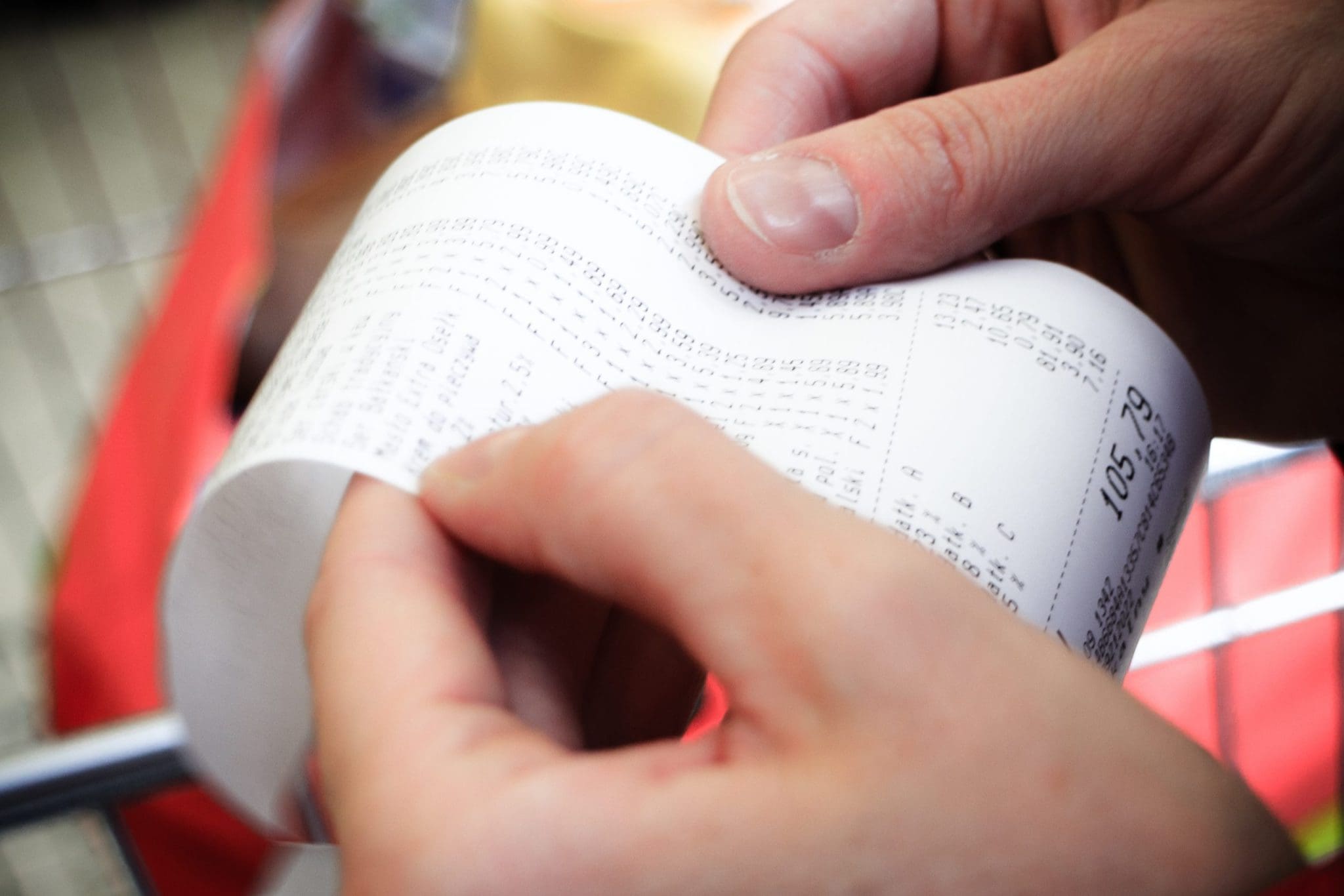

Understanding Letters of Medical Necessity for HSAs FSAs and HRAs

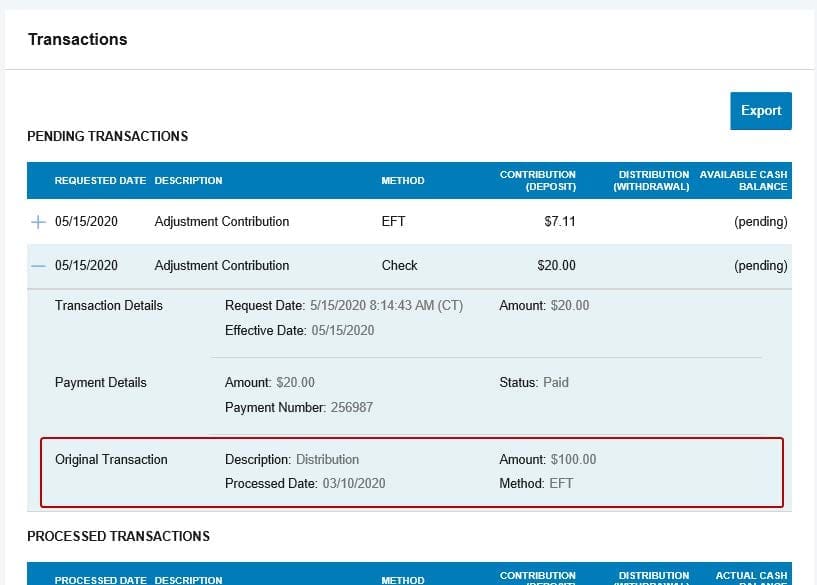

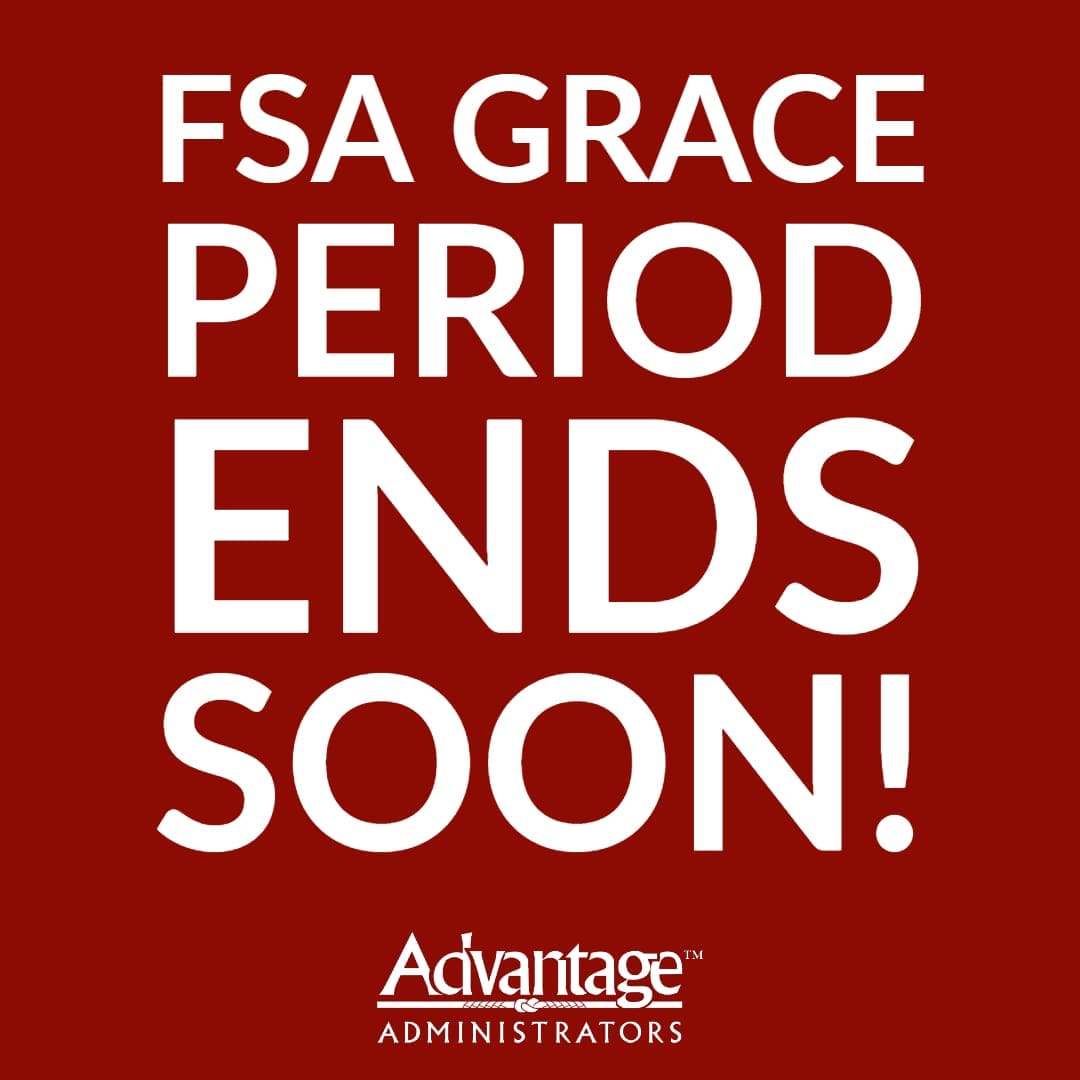

When managing pre-tax health accounts such as HSAs, FSAs and HRAs, it is easy to assume that all medical expenses automatically qualify for reimbursement. However, some services and products require additional documentation before they are considered eligible. That documentation is called a Letter of Medical Necessity. If you or your employees have ever been asked...

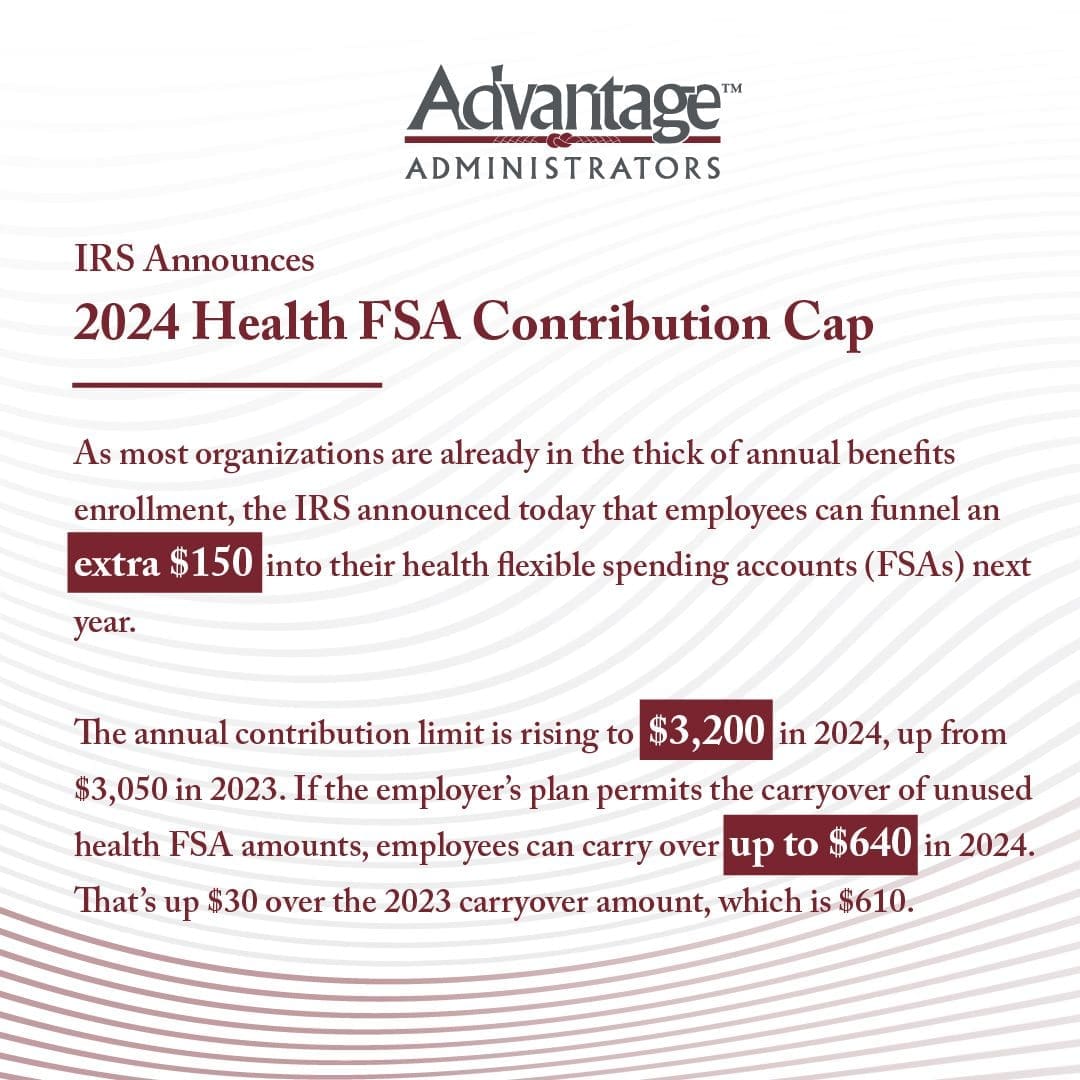

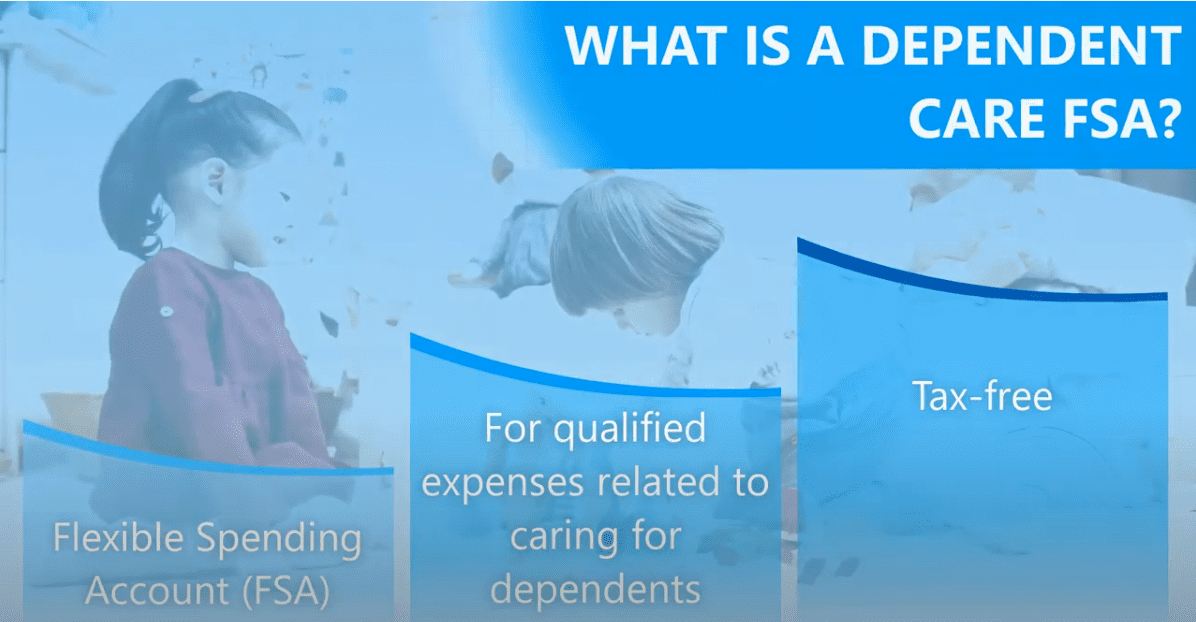

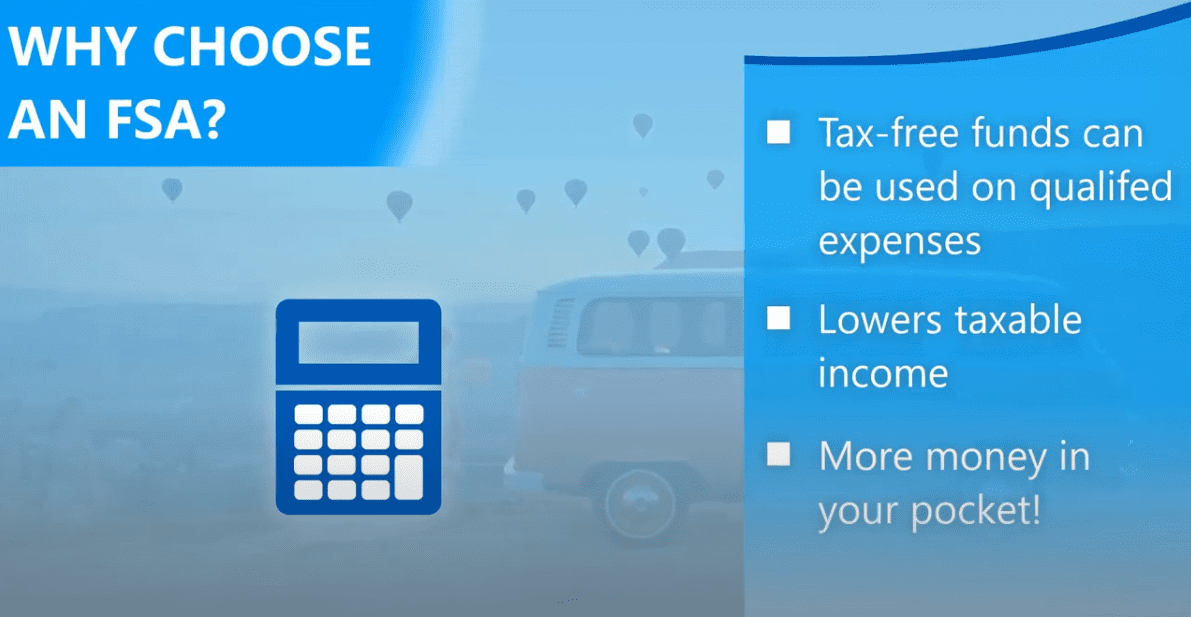

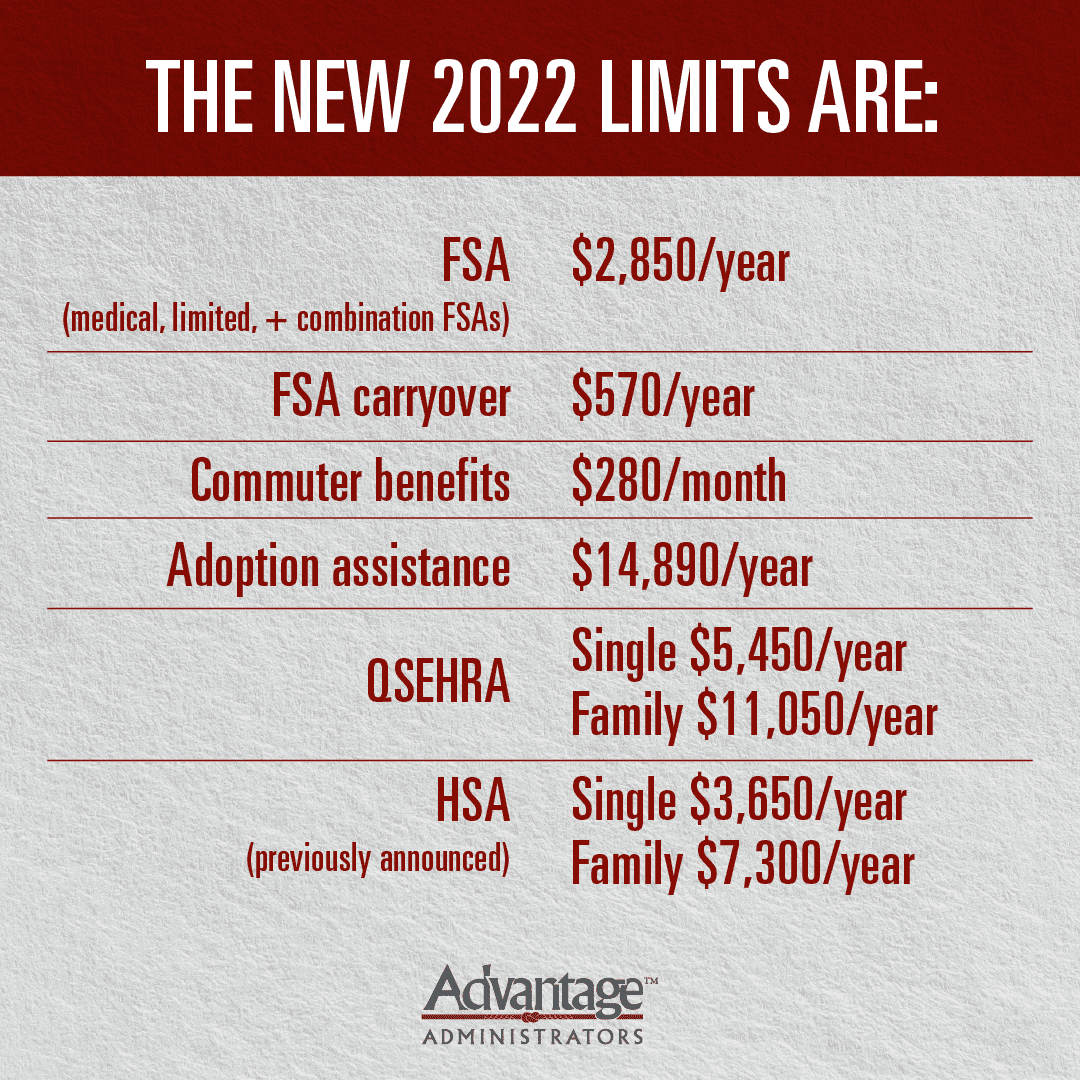

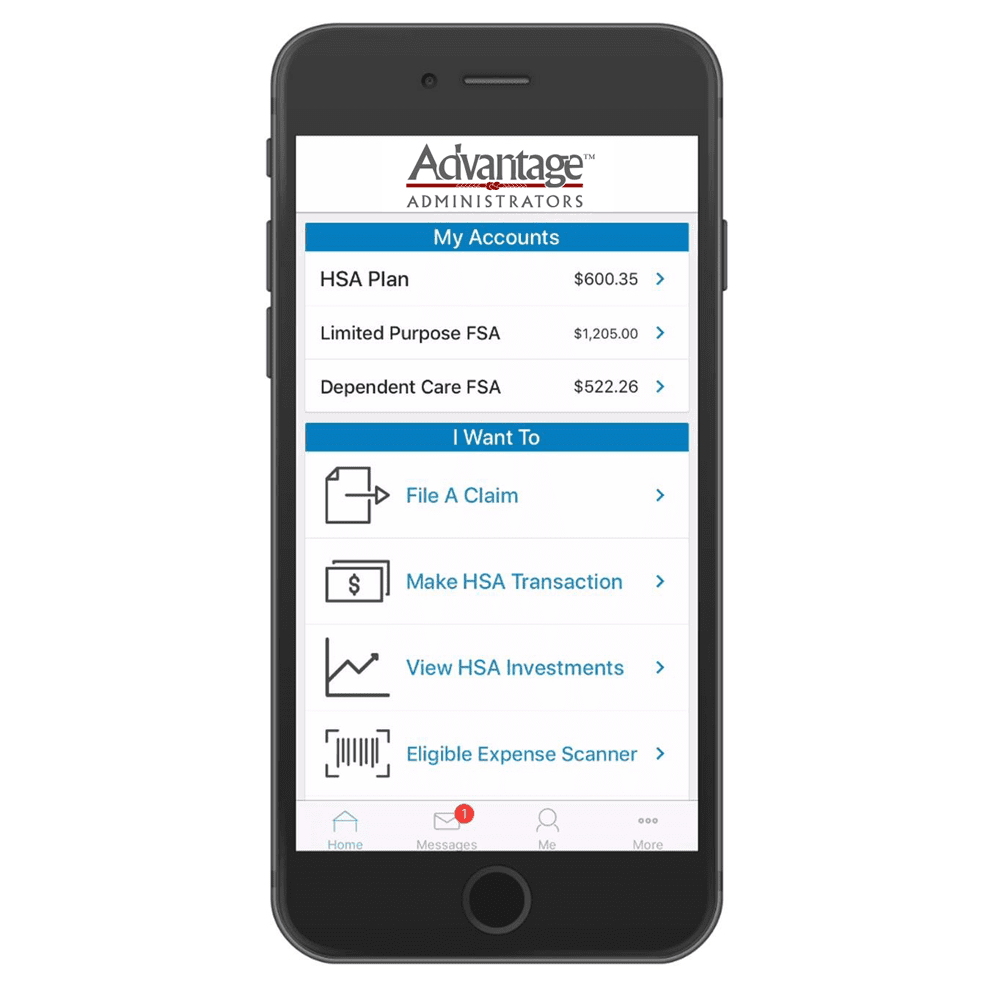

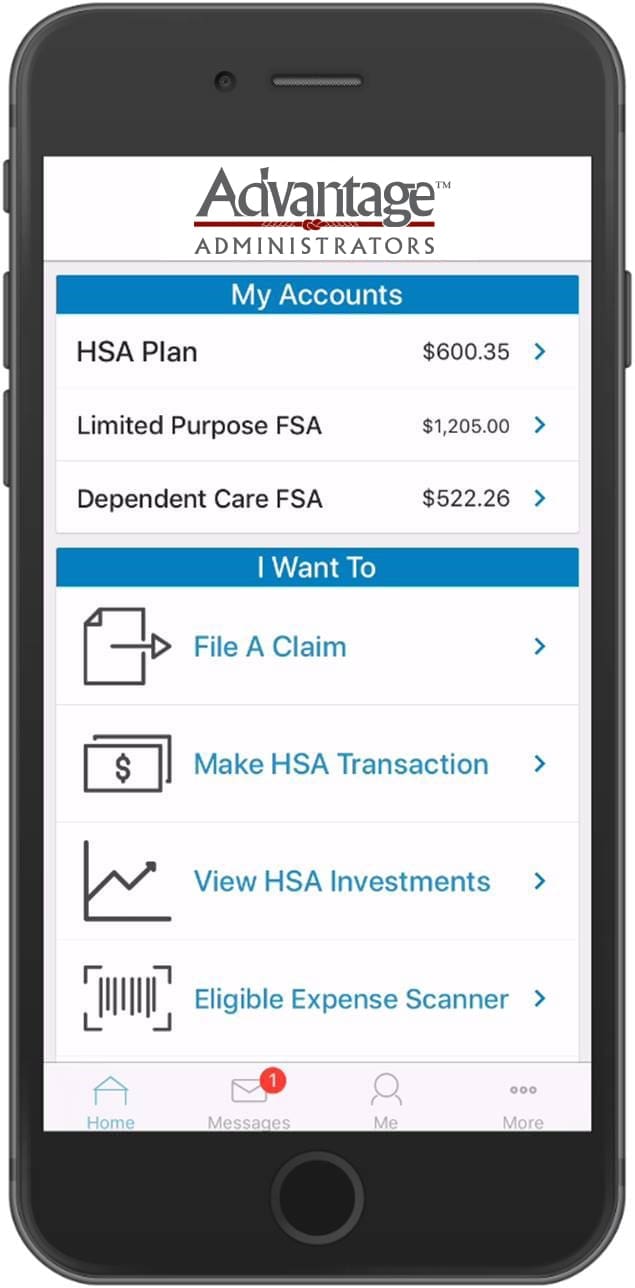

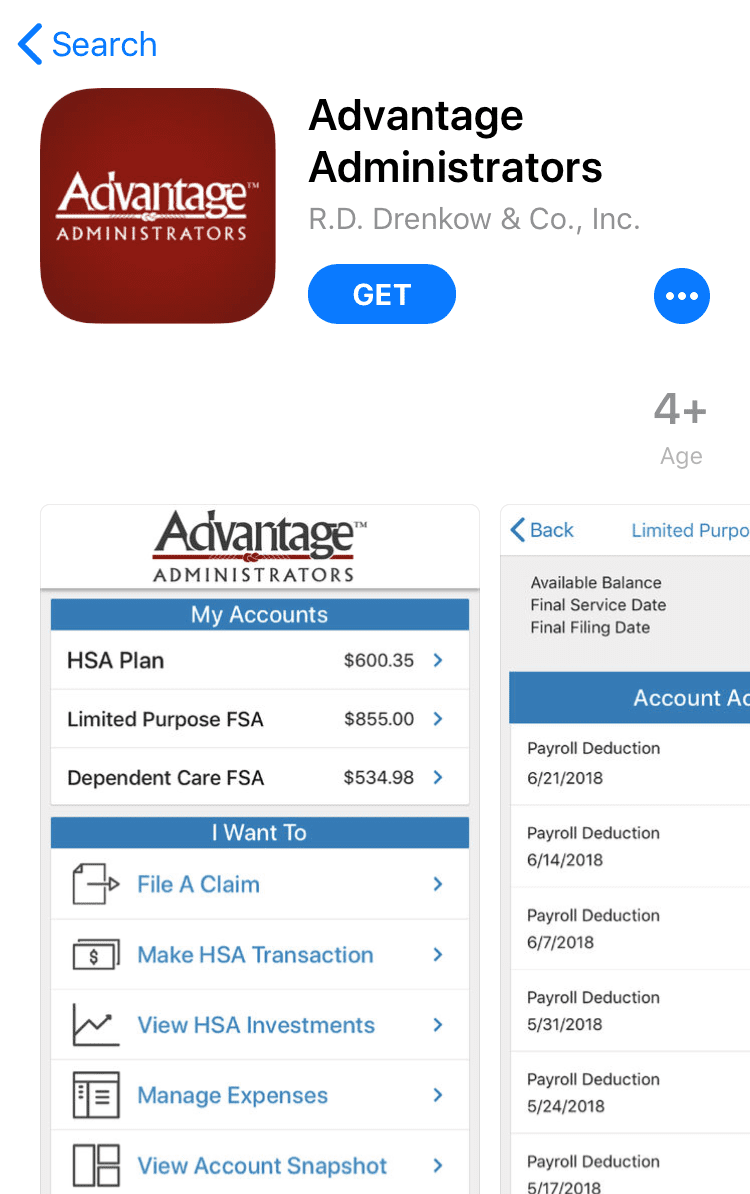

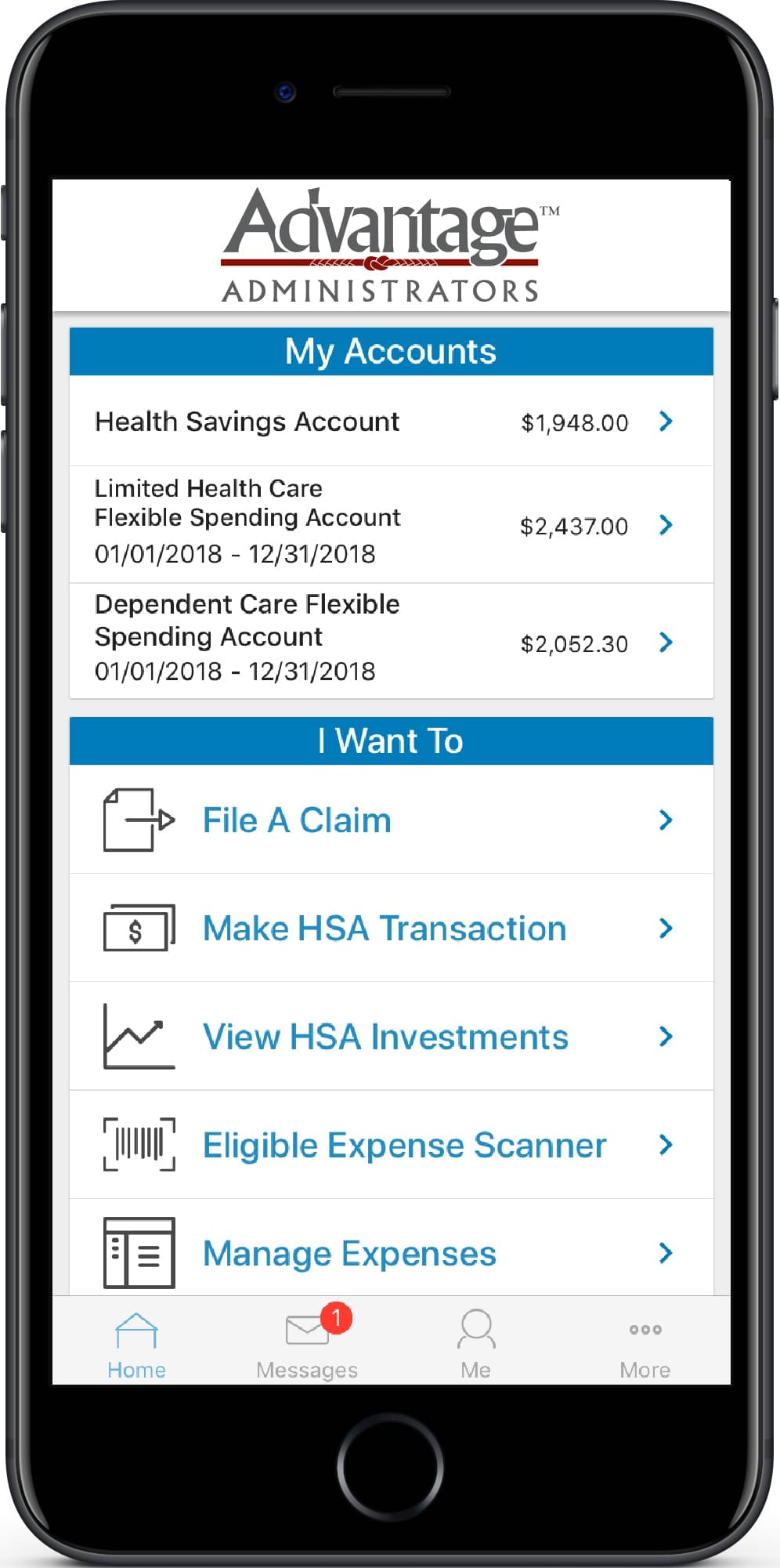

Flex Plans

Flex Plans Forms

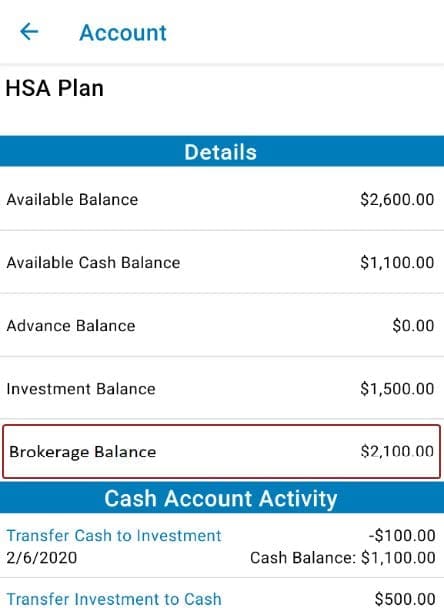

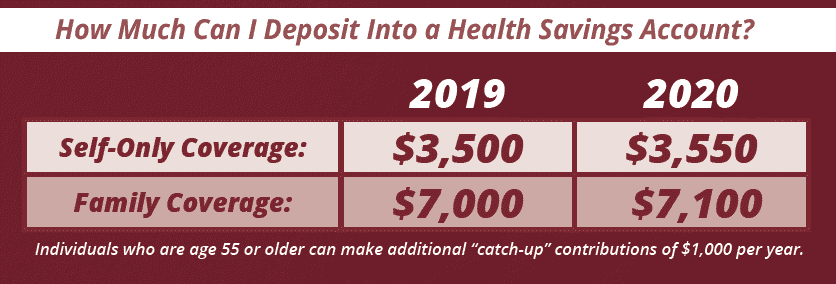

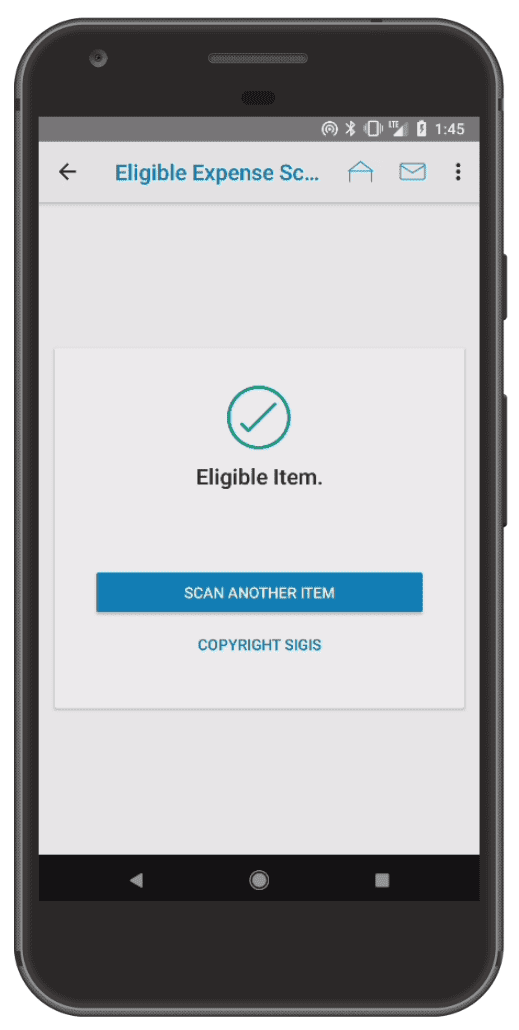

Forms HSA

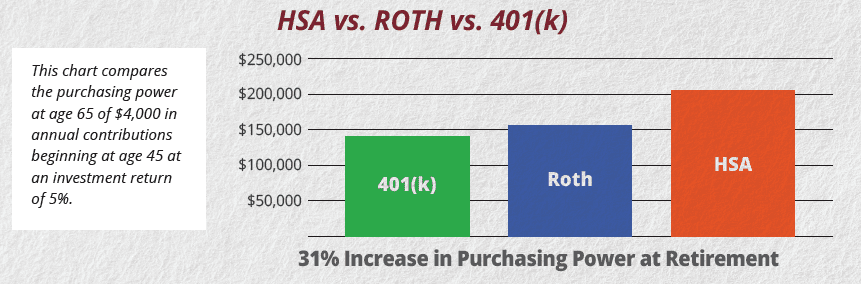

HSA HRA

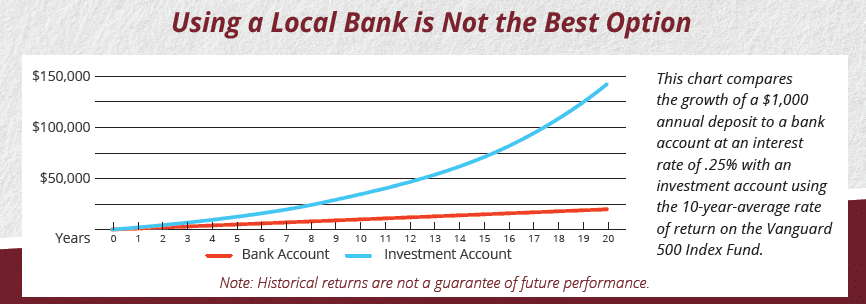

HRA Retirement

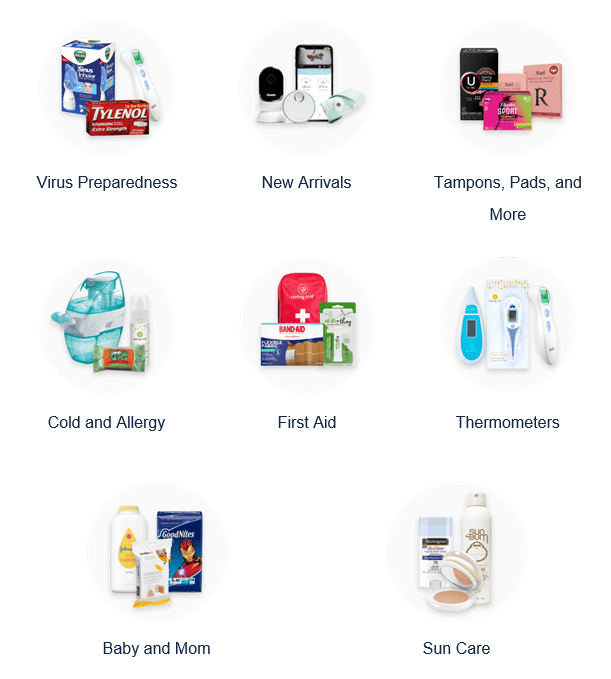

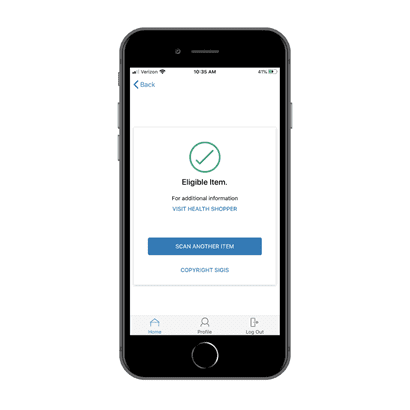

Retirement Health Shopper

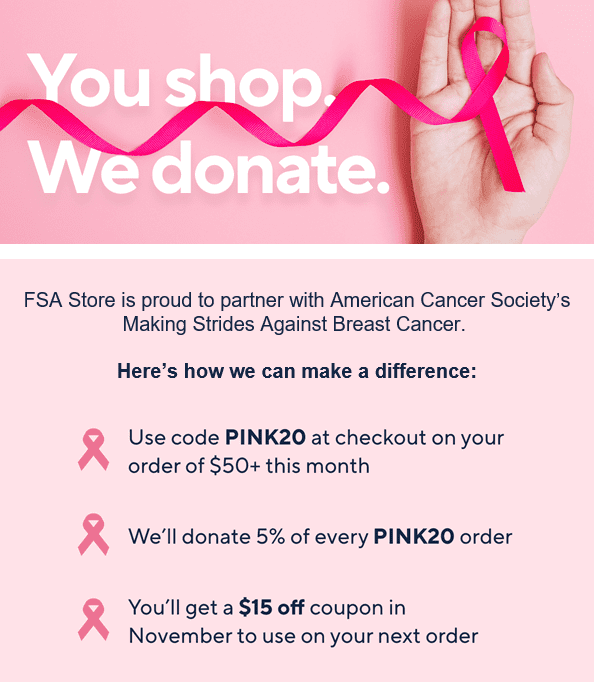

Health Shopper FSA Store

FSA Store